by James D. Agresti

The U.S. Treasury has published a major report revealing that the federal government has amassed $103.7 trillion in debts, liabilities, and unfunded obligations. To place this unprecedented shortfall in perspective, it amounts to:

- $315,315 for every person living in the U.S.

- $806,181 for every household in the U.S.

- 4.8 times the size of the U.S. economy.

- 29 times annual federal revenues.

- 91% of the combined net worth of all U.S. households and nonprofit organizations, including all assets in savings, real estate, corporate stocks, private businesses, and consumer durable goods such as automobiles and furniture.

The new data reflect the government’s finances at the close of its 2019 fiscal year on September 30th. Thus, they don’t include added spending that has been passed and proposed to support individuals, businesses, and the general economy in the wake of the Covid-19 pandemic.

This official report is mandated by a federal law that requires the Treasury and White House to produce a full accounting of the government’s “overall financial position” by no later than March 31st of each year. Beyond the national debt, it also includes the government’s explicit and implicit commitments. This method approximates the accounting standards that the federal government imposes on publicly traded corporations.

Unlike higher estimates of the federal government’s fiscal shortfall that extend indefinitely into the future, these figures only include Americans who are alive right now. Thus, they estimate the burden that today’s Americans are placing on future generations.

Although the report discloses information of crucial import to U.S. citizens, Google News indicates that no media outlet has informed Americans about it since it was released on February 27th.

A Full Accounting

As explained by the U.S. Treasury, the federal government’s budget is “prepared primarily on a ‘cash basis’,” which is an incomplete measure of its finances. This is because cash accounting is the simple process of counting money as it flows in or out. For example, when federal workers earn pension benefits, cash accounting ignores these liabilities until they are paid out—which is often years or decades later.

In contrast to cash accounting, accrual accounting measures financial commitments when they are made. This is the method used in the Treasury’s latest Financial Report of the United States Government. The U.S. Government Accountability Office explains that the report does this “to provide a complete picture of the federal government’s financial operations and financial position.”

The federal government requires large corporations to use accrual accounting for their pension plans because this is the “most relevant and reliable” way to measure their financial health. The same applies to other retirement benefits like healthcare. The official statement of this rule explains that “a failure to accrue” implies “that no obligation exists prior to the payment of benefits.” Since an obligation does, in fact, exist, failing to account for it “impairs the usefulness and integrity” of financial statements.

Nevertheless, the media and politicians routinely cite the federal budget, while ignoring far more comprehensive and bleaker data from the Treasury.

Federal Employee Retirement Benefits

The differences between the federal budget and the broader Treasury data have major consequences for future taxpayers, partly because pension and other retirement benefits are a large part of compensation packages for government employees. When these benefits are included, civilian, non-postal federal employees receive an average of 17% more total compensation than private-sector workers with comparable education and work experience. Postal workers receive even greater premiums ranging from 25% to 43%.

In 2018, federal, state, and local governments spent $2.01 trillion on employee compensation. Paying this took an average of $15,771 from every household in the United States.

The Treasury report shows that the federal government currently owes $8.4 trillion in pensions and other benefits to federal employees and veterans. To pay the present value of these benefits would require an average of $65,643 from every household in the United States. Yet, the vast majority of these liabilities are not reflected in the national debt.

Social Security & Medicare

A similar situation exists with social insurance programs like Social Security and Medicare because—contrary to popular belief—these programs don’t save workers’ tax contributions for their retirements. Instead, they immediately spend the vast majority of those taxes to pay out benefits to current recipients. Hence, Social Security and Medicare are called “pay-as-you-go” programs.

In stark contrast, the U.S. Bureau of Economic Analysis states that “federal law requires that private pension plans operate as funded plans, not as pay-as-you-go plans.” The reasons for this, as explained by the American Academy of Actuaries, are to increase “benefit security” and ensure “intergenerational equity.”

Social Security and Medicare, on the other hand, have levied increasing tax burdens on succeeding generations of Americans and have accumulated trillions of dollars in unfunded obligations.

Federal actuaries measure the unfunded obligations of Social Security and Medicare in several different ways, but only one of them approximates accrual accounting. This is called the “closed-group” unfunded obligation, which is the money needed to cover the shortfalls for all current taxpayers and beneficiaries in these programs.

In the words of Harvard Law School professor and federal budget specialist Howell E. Jackson, the closed-group measure “reflects the financial burden or liability being passed on to future generations.” These burdens are $35.2 trillion for Social Security and $42.3 trillion for Medicare. To place these figures in context:

- Social Security’s unfunded obligations amount to an additional $200,030 from every person who currently pays Social Security payroll taxes.

- Medicare’s unfunded obligations amount to an additional $161,344 from every U.S. resident aged 15 or older.

Those shortfalls are what remain after the federal government has paid back with interest all of the money it has borrowed from Social Security and Medicare. This speaks to the common myth the federal government has looted Social Security. In reality, the federal government has repeatedly boosted Social Security by raising its payroll tax rate, increasing its inflation-adjusted taxable maximum, and injecting other taxes to its income stream.

Yet, the program is still facing insolvency, mainly because the ratio of workers paying taxes to people receiving benefits has fallen by three times since 1955 and is projected to fall further.

Social Security and Medicare differ from true pensions because taxpayers don’t have a contractual right to receive these benefits. Nevertheless, paying these benefits is an implied commitment of the federal government, and federal law requires that these programs be included in the Treasury report.

Other Obligations

Beyond the national debt, federal employee retirement benefits, and Social Security and Medicare shortfalls, the Treasury details other obligations of the federal government. These, include, for example:

- $98 billion in accounts payable.

- $595 billion in environmental and disposal liabilities.

- $194 billion in insurance and guarantee program liabilities

Federal Assets

The Treasury report also measures the federal government’s commercial assets, such as:

- $525 trillion in cash and other monetary assets.

- $1.4 trillion in receivable loans.

- $1.1 trillion in property, plants, and equipment.

The report, however, doesn’t account for federal stewardship land and heritage assets, such as national parks and the original copy of the Declaration of Independence. While these items have tangible value, the report explains that these “are intended to be preserved as national treasures,” not sold to cover debts.

In total, the government owned $4.0 trillion in commercial assets at the close of its 2019 fiscal year.

The Grand Total

Adding up the federal government’s debts, liabilities, and unfunded obligations and then subtracting the value of its commercial assets yields a fiscal shortfall of $103.7 trillion. This is an increase from $95.4 trillion in the previous year, marking the first time the red ink has exceeded $100 trillion.

Moreover, the actual figure may be significantly worse because the Treasury’s data is based on federal agency assumptions that are optimistic in these key respects:

- A paper in the journal Demography found that the Social Security Administration is using an antiquated method to project life expectancies, and as a result, the program “may be in a considerably more precarious position than officially thought.”

- When the federal government makes student loans, it projects that it will eventually reap a 9% average profit from interest on the loans. However, the Congressional Budget Office has determined that if the federal government accounted for the market risk of these loans, it would show an average loss of 12% on every dollar it lends.

- The Board of Medicare Trustees has stated that Medicare’s long-term costs may be “substantially higher” than projected under current law. This is because the price controls in the Affordable Care Act will cut Medicare prices for many medical services over the next three generations to “less than half of their level under the prior law.” The actuaries have been clear that this will likely cause “withdrawal of providers from the Medicare market” and “severe problems with beneficiary access to care.”

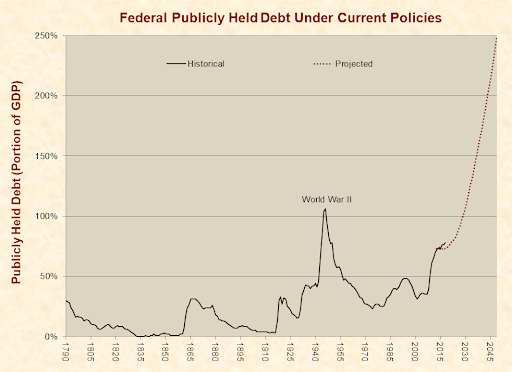

In 2013, the Congressional Budget Office (CBO) ran a long-term projection of the publicly held debt, which is a partial measure of the national debt often cited by federal agencies and media outlets.

This projection was unique in that it estimated what would occur under current federal policies and their economic effects. It found that the debt would grow over the next two decades to unprecedented levels unless the government changed course. Nearly six years later, the actual outcomes were slightly worse:

Drivers

Contrary to narratives spread by the media, the national debt has not been mainly driven by tax cuts or military spending. Instead, it has been stoked by increased outlays for social programs that provide healthcare, income security, education, nutrition, housing, and cultural services. These programs have grown from 20% of all federal spending in 1959 to 62% in 2018:

Under current laws and policies, the Congressional Budget Office projects that almost all future growth in spending will be due to social programs and interest on the national debt.

Under current laws and policies, the Congressional Budget Office projects that almost all future growth in spending will be due to social programs and interest on the national debt.

Harmful Effects

A broad range of academic publications explain that excessive government debt can cause far-reaching negative outcomes, such as lower wages, weak economic growth, increased inflation, higher taxes, reduced government benefits, or combinations of such results.

Likewise, the U.S. Government Accountability Office warns that “the costs of federal borrowing will be borne by tomorrow’s workers and taxpayers,” which “may reduce or slow the growth of the living standards of future generations.”

Such effects may have already begun. Although association does not prove causation, the national debt has risen dramatically over past decades, and with this, the U.S. has experienced episodes of historically poor growth in gross domestic product, productivity, and household income.

While some believe the U.S. government can spend and borrow with abandon because it is so large and can , one of the most established laws of economics is that there no such thing as a free lunch. The prolific economist William A. McEachern explains why this is so:

There is no free lunch because all goods and services involve a cost to someone. The lunch may seem free to you, but it draws scarce resources away from the production of other goods and services, and whoever provides a free lunch often expects something in return. A Russian proverb makes a similar point but with a bit more bite: “The only place you find free cheese is in a mousetrap.”

– – –

James D. Agresti is the president of Just Facts, a think tank dedicated to publishing rigorously documented facts about public policy issues.