by Spencer Morrison

Between 1348 and 1352 a monstrous plague – the Black Death – ravaged Europe. The disease struck young and old, men and women, saint and sinner alike. Half the population died. Whole cities disappeared. Western Civilization was on the brink of collapse.

What caused this plague? Bad smells. Foul odors. The stench of decay. This was considered unequivocal, scientific fact – that is until we invented the microscope and discovered that an entire world of miniature animalcules existed right under our noses. In time we realized that these creatures caused illness: germ theory was born, and with it died the centuries-old miasma theory of disease.

Received wisdom – no matter how venerable – should always be treated with a healthy dose of skepticism. This is especially true when it comes to economics, as money brings out hucksters who sell snake-oil bottled as genuine emollients.

Bluntly: many economists are crooks and liars.

The biggest lie they tell us is that international free trade makes stuff cheaper. It doesn’t. It simply enriches the white-collar gangsters who run our banks – the very people who so often fund “libertarian” think tanks. Go figure.

The Bigger the Lie . . .

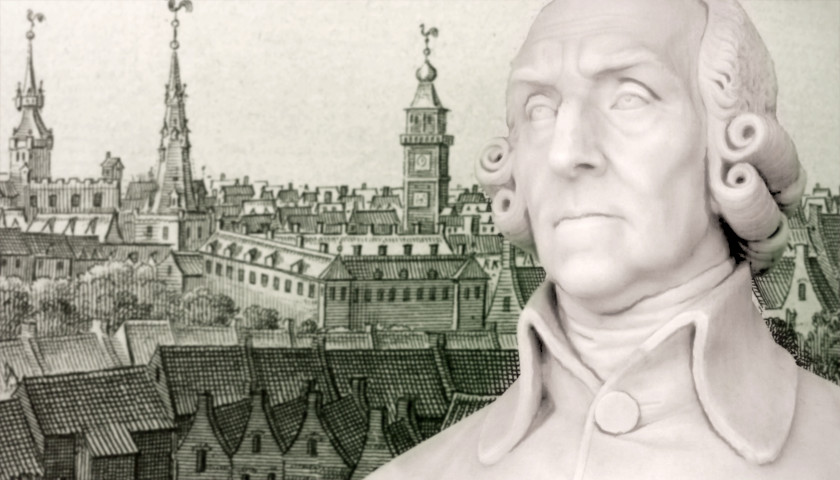

Free-trade theory is based on the work of the two titans of economics: Adam Smith and David Ricardo. In The Wealth of Nations, Adam Smith explained that prosperity is a function of productivity, and productivity is itself a function of labor specialization: more specialization means more productivity, and more wealth.

Smith fleshed out his idea in his now-classic example. Imagine two pin workshops. In one workshop each artisanal worker makes his pin from start to finish, meticulously stretching the wire and hammering-down the pinhead. At that rate each man “could scarce, perhaps, with his utmost industry, make one pin a day.” In the other workshop the men divide their labor so that each handles one simple task:

One man draws out the wire, another straights it, a third cuts it, a fourth points it, a fifth grinds it at the top for receiving the head . . . the important business of making a pin is, in this manner, divided into about eighteen distinct operations . . . I have seen a small manufactory of this kind where ten men only were employed . . . [and by dividing their labor] those ten persons, therefore, could make among them upwards of forty-eight thousand pins a day.

For Smith, the key to prosperity is an efficient division of labor. Likewise, the key to economic growth is to divide labor – to break production steps into smaller and smaller chunks. This works, but only in the short term. In reality, Smith’s pin-makers can only subdivide their task so many times before the process is maximally efficient. Once this point is reached, additional economic growth is impossible according to Smith’s theory.

And yet economic growth continues unabated. Why? Because technology drives long-run economic growth, not labor specialization. This fact is painfully obvious.

For example, books used to be made in monasteries. Lone monks would meticulously ink each word in delicate calligraphy, and illuminate the manuscripts with indigo dyes and beaten gold. The Book of Kells is one of the most glorious examples of this art.

By the dawn of the Renaissance, books were big business. Workshops filled with scribes copied texts, while binders bound the volumes, and illustrators illuminated the pages. Adam Smith would have been proud. By roughly 1450, the Europeans had maximized the division of labor in bookmaking – it was the end of the line for Smithian growth.

Then along came the printing press. Suddenly, whole pages could be printed in seconds by an illiterate peon. This increased productivity exponentially and dramatically reduced prices. In Renaissance Florence, for example, a scribe could produce a copy of Plato’s Dialogues for one florin. In 1483, the Ripoli printing press opened up shop. It could produce 1,025 copies of Plato’s Dialogues for three florins – the price to print this book plummeted by a multiple of 341, or 99.71 percent!

This is not an isolated incident: the same thing happened with the invention of railroads, forklifts, and computers. Technology, not labor specialization, is what drives long-run economic growth. This explains why the Soviet Union, despite its comically bad allocation of labor, was an order of magnitude richer than Victorian Britain, whose division of labor was par excellence – and infinitely more prosperous than Mycenaean Greece, despite the latter’s sophisticated and “internationally” integrated market economy.

Although this is news to most economists, my point is not new. Robert Solow in 1956 found that technological progress accounted for 80 percent of the long-term rise in America’s per capita income. The remaining 20 percent was caused by capital accumulation. How much was caused by a more efficient division of labor in a Smithian sense?

Zero.

This is a big problem for free traders, who argue that free trade makes America richer by increasing the available labor supply, and thus increasing the degree to which we can specialize our labor. Not only is this wrong, it lacks even the faintest air of reality—and yet propaganda mills like the Cato Institutechurn out reams of articles dedicated to pushing this myth on the American public.

“Man . . . How Ignorant Art Thou in Thy Pride of Wisdom!”

In his magnum opus On the Principles of Political Economy and Taxation, David Ricardo explains that international free trade enriches countries by allowing them to maximize their comparative advantage. The theory of comparative advantage is the linchpin of the free trade movement. Unfortunately, comparative advantage is a sham.

At its heart, the theory is straightforward: countries should trade things they are relatively good at making for things they are relatively bad at making. This makes the economy more efficient, and therefore makes everyone richer.

To illustrate his point, Ricardo concocted a now-classic example: suppose there are two countries, England and Portugal. Both make cloth and wine. It takes England 100 man-hours to make a bolt of cloth and 120 hours to make a barrel of wine (220 hours to make one unit of each). Clearly England is relatively better at making cloth than wine.

Meanwhile in Portugal it takes only 90 hours to make a bolt of cloth and 80 hours to make the wine (170 hours to make one unit of each). Although Portugal is absolutely better at making both products, it is relatively better at making wine than cloth. Thus, Portugal has a comparative advantage in making wine, and England has one in making cloth. Ricardo concludes that each country should specialize in making what they are best at (England, cloth; Portugal, wine) and trade with each other to acquire the rest.

Mathematically, comparative advantage makes some sense. If neither country specialized, it would take 220 hours for England to make one unit of cloth and one unit of wine, while Portugal would take 170 hours. But if they both specialized and traded, then the same labor could make 2.2 units of cloth and 2.125 units of wine—like magic, specialization and trade makes everyone richer.

Free traders argue that this logic applies globally. If every region specialized in making goods for which it has a comparative advantage, then the global economy would be maximally efficient and we would all be richer.

The extrapolation is mistaken.

Ironically, the best critique of comparative advantage comes from David Ricardo himself, who acknowledges that his theory is domain-specific – it only applies when certain antecedent conditions are met. Ricardo writes:

. . . it would undoubtedly be advantageous to the capitalists [and consumers] of England… [that] the wine and cloth should both be made in Portugal [and that] the capital and labour of England employed in making cloth should be removed to Portugal for that purpose.

Ricardo says explicitly that comparative advantage suggests that it makes sense for England to import both cloth and wine from Portugal, and that England’s cloth-making industry should be – to use modern parlance – offshored to Portugal.

Of course, Ricardo knows this would be a losing strategy for England. If England imported everything and made nothing, it would have no economy. Further, England would be vulnerable to foreign suppliers. Ricardo adds an intellectual buttress to ensure that the temple of trade will not collapse. He writes: “most men of property [will be] satisfied with a low rate of profits in their own country, rather than seek[ing] a more advantageous employment for their wealth in foreign nations.”

There you have it, comparative advantage – global free trade itself – is based on the assertion that men love their country more than money, and will invest domestically because they are patriotic. Fat chance. Gordon Gekko was right: “greed is good.” Greed is the name of their game.

Ricardo also used a more technical defense of comparative advantage from this obvious flaw. He argued that offshoring is impossible because capital is immobile – England’s textile mills could not move to Portugal. This is the antecedent condition I mentioned earlier. Comparative advantage is domain-specific because it only applies when capital is immobile and thus offshoring cannot occur.

But of course, capital is highly mobile in today’s economy – a factory can be relocated from the United States to China virtually overnight and transportation for bulk goods is unbelievably cheap. Despite this obvious, and explicit limitation, the free-trade brigade routinely trots out the theory of comparative advantage in defense of free trade as if it were a prize stallion. In reality, it is a dead horse.

Because free trade has nothing to do with long-run economic growth, it necessarily has nothing to do with long-run reductions in consumer prices. As such, the entire “freer trade means cheaper goods” argument is nothing but a myth perpetrated by jesters and charlatans. Be warned.

– – –

Spencer P. Morrison is a writer and author of Bobbins, Not Gold. He is the editor-in-chief of the National Economics Editorial. Follow him on Twitter @SPMorrison_.