by John Hugh DeMastri

Despite claims from Biden administration officials that new funding for the Internal Revenue Service (IRS) will not increase the auditing burden on individuals and small businesses, a Friday letter from the Congressional Budget Office (CBO) reveals new auditing activity targeting taxpayers who report less than $400,000 per year will be expected to contribute to about $4 billion in revenue.

Treasury Secretary Janet Yellen on Aug. 10 directed the IRS to not use the $79 billion funding increase granted to the organization in the Inflation Reduction Act to increase the “share of small business or households below the $400,000 threshold that are audited relative to historical levels.” White House Press Secretary Karine Jean-Pierre told reporters “No. Very Clear. No.” when asked if there would be new audits on “anyone” making less than $400,000 per year, and Yellen herself said that “small business[es] or households making less than $400,000 per year will not see an increase in the chances that they are audited,” in the directive’s announcement.

However, the CBO now expects that new auditing efforts targeting individuals making less than $400,000 per year will partially account for $4 billion of $180 billion in revenue over the next 10 years, alongside reduced administrative costs, according to a letter containing updated revenue projections written by CBO Director Phillip Swagel. This expectation accounts for Yellen’s directive, with the CBO estimating that if the Inflation Reduction Act had included language prohibiting new audits on those reporting less than $400,000, the IRS would expect about $4 billion less in revenue than if it only followed Yellen’s directive.

However, the CBO now expects that new auditing efforts targeting individuals making less than $400,000 per year will partially account for $4 billion of $180 billion in revenue over the next 10 years, alongside reduced administrative costs, according to a letter containing updated revenue projections written by CBO Director Phillip Swagel. This expectation accounts for Yellen’s directive, with the CBO estimating that if the Inflation Reduction Act had included language prohibiting new audits on those reporting less than $400,000, the IRS would expect about $4 billion less in revenue than if it only followed Yellen’s directive.

KJP: “This is not about folks who make less than $400k.”

DOOCY: “So no new audits on anybody making under $400k a year?”

KJP: “No. Very Clear. No.” pic.twitter.com/gqC3UfFHdW

— Townhall.com (@townhallcom) August 9, 2022

“Some taxpayers reporting income of less than $400,000 on their tax return, for whom the proposed amendment would have barred audits using the new funding, will be found to have more income than they reported—in some cases, income greater than $400,000—if they are audited,” said the CBO, clearly stating that the IRS is expected to use “new funding” for the purpose of auditing additional taxpayers.

Heritage Foundation economist EJ Antoni stressed to the Daily Caller News Foundation that new funding could still be used for enforcement activity that isn’t auditing, such as document matching. The letter also noted that without Yellen’s directive, which Antoni noted is not a law and could be changed at any time by the director or a potential replacement, the amount of revenue generated from audits could jump as high as $20 billion.

The CBO originally estimated that new funding for the IRS would lead to a revenue increase of $203.7 billion over the next 10 years, but cut that expectation by $23 billion to $180.4 billion in the letter.

IRS spokesman Anthony Burke declined to comment over the phone on the CBO director’s letter, and did not immediately respond to a DCNF email containing follow-up questions. IRS spokesman Raphael Tulino referred the DCNF to an Aug. 16 statement by IRS Commissioner Chuck Rettig that did not contain any comments about auditing.

The White House did not immediately respond to a DCNF request for comment.

– – –

John Hugh DeMastri is a reporter at Daily Caller News Foundation.

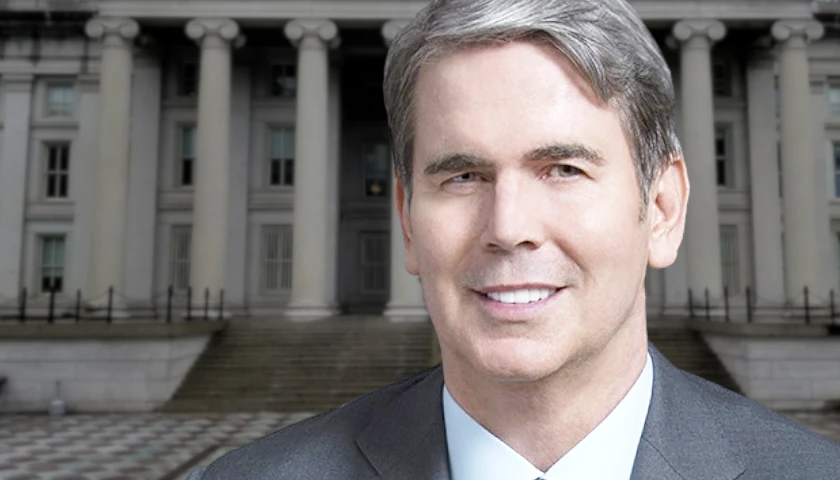

Photo “Internal Revenue Service” by IRS Office of Chief Counsel.