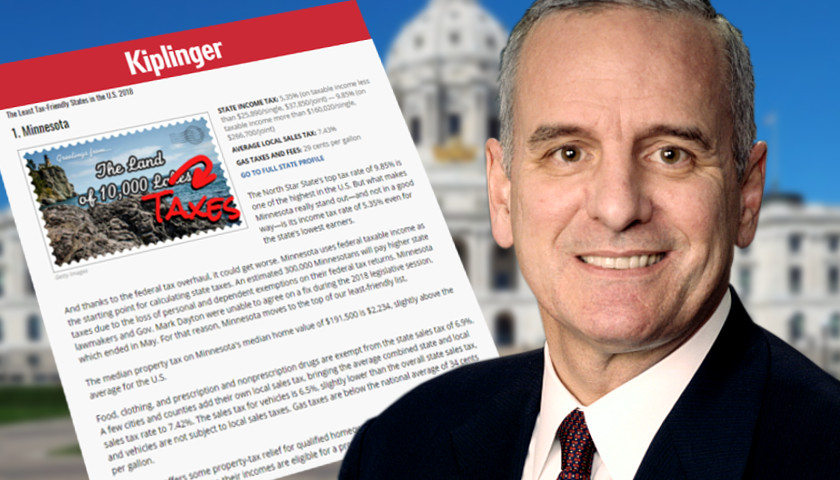

If there were trillions of dollars socked away in convenient vehicles to avoid taxes and benefit the ultra-elite should we not tax them? Are they not fair game in a just system of taxation, where the little guy and the middle class have to pay up—or else?

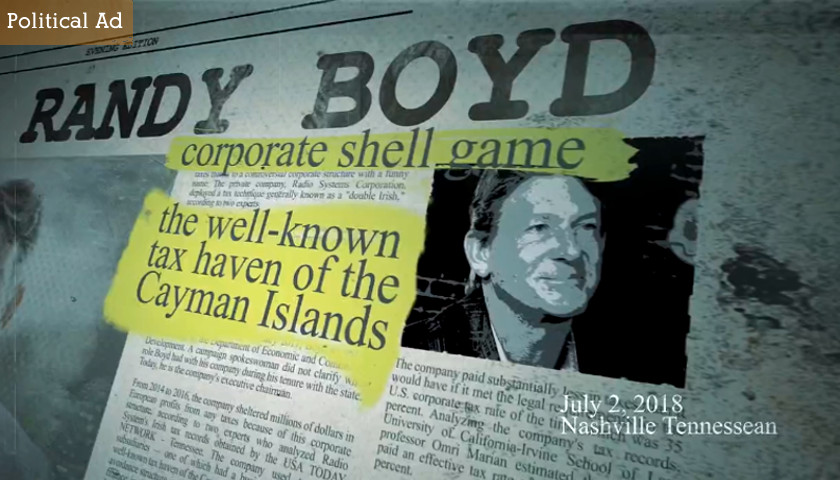

The largest endowments, mainly universities indoctrinating students in social justice, wokeism, and class warfare, pay absolutely no taxes.

The big foundations, promoting radical left-wing activism, likewise pay no taxes.

Read More