For decades, I taught a course in European economic history that stressed the Industrial Revolution and its aftermath and spent a couple of lectures talking about the Roman Empire and other ancient civilizations. The Roman Empire lasted over 500 years (by some accounts, even longer) but ultimately declined and fell. Is America and its world leadership (rather than “empire”) undergoing a remarkably similar decline? Is history eerily repeating itself well over a millennium later?

Read MoreTag: monetary policy

Commentary: Dethroning King Dollar

Joe Biden is dethroning King Dollar in real time. The US dollar’s financial dominance is under siege from a uniquely bad combination of foreign and domestic policies, and Americans should be deeply concerned by the fallout if the dollar loses its 80-year reign as the world’s reserve currency.

In just the past weeks, China conducted the first major LNG sale in renminbi instead of dollars, struck a major deal with Brazil to conduct trade in their own currencies, and just announced the sale of 65,000 tons of LNG to France denominated in yuan. This dovetails with the Biden administration’s inflationary policies and ham-handed sanctions on Russia that accelerated foreigners’ flight from the dollar at the very moment the world doubts if the dollar remains a safe and reliable store of value.

Read MoreInflation Continues to Outpace Wages, Data Shows

Inflation has outpaced wages for nearly two years, recently released federal data shows.

A closer look at federal wage and pricing data shows workers are making less overall as the price for all kinds of goods and services rise faster than average hourly wages.

The U.S. Bureau of Labor Statistics tracks “real” average hourly earnings, which are wages of Americans with rising inflation taken into account.

Read MoreCommentary: Wokeness Is Hollowing Out The Fed

Are you wondering why checking out at the grocery store these days feels like making a mortgage payment? This week’s four-decade-high inflation is a direct result of the Federal Reserve taking its eye off the ball over the last two years. Instead of focusing on its mandate of keeping prices stable, it has been more concerned with financing massive federal deficits and kowtowing to liberal ideology.

But now the Fed chair is claiming just the opposite.

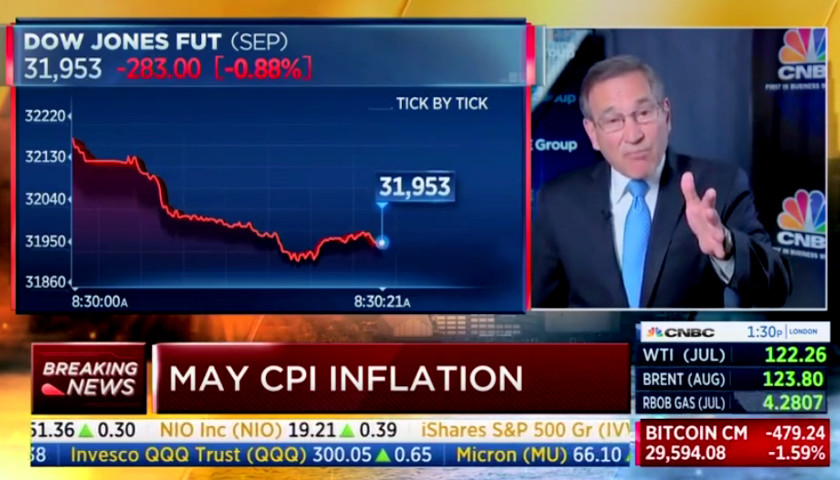

Read MoreCNBC’s Rick Santelli Hammers Biden’s Inflationary Energy Policies

CNBC editor Rick Santelli unloaded on the Biden administration on CNBC’s “Squawk Box” Friday morning, saying anti-fossil fuel policies helped to spur inflation.

“What was the forward guidance with this administration on energy?” Santelli asked. “We know the answer. Maybe they can’t get things to happen faster, but by giving positive forward guidance, by not closing pipelines, by not talking pre-election about how much they don’t like fossil fuel, maybe things would have turned out a bit different.”

Read MoreCommentary: Hawley Is Asking the Right Questions About the Dollar

Senator Josh Hawley (R-Mo.) has wasted very little time in becoming one of the most important senators in this new freshman class.

Read More