President-elect Donald Trump endorsed an agreement by House Republican leaders to fund the government through March 2025 and lift the debt ceiling until 2027.

Read MoreTag: debt ceiling

Commentary: The Real Cost of the Debt-Ceiling Deal

President Joe Biden and House Speaker Kevin McCarthy spent weeks of negotiating to authorize $4 trillion in new deficit spending over the next two years. This means that our national debt will be $35 trillion in 2025. The interest cost will be up to $1.4 trillion annually, only a small amount less than the current cost of national defense and Social Security combined. This staggering debt undermines the future prosperity of every American.

Federal spending contributes to a sense of entitlement, including for every person receiving federal largesse. Think of the adverse impact of federal student loans. President Barack Obama promised that government-granted student college loans would be more efficient, but these loans have, in fact, ballooned the cost of college. Concurrently, colleges have reduced quality outcomes and propagandized students, undermining our society because many students are hopelessly in debt. Now, progressives in Congress want to terminate the provision requiring repayment of student loans. For many of our young workforce, the burden of high student loans precludes marriage and buying a house.

Read MoreTea Party Patriots Action Condemn House Speaker McCarthy for Debt Ceiling Deal, Urge Republicans to Vote in Opposition

Tea Party Patriots Action (TPPA), the national conservative nonprofit group founded at the height of the Tea Party Movement, is condemning House Speaker Kevin McCarthy (R-CA-20) for negotiating an increase of $4 trillion to the national debt over the next 18 months and calling on House Republicans to vote against the bill.

Read MoreGOP-Led House Expected to Vote Wednesday on Debt Limit Compromise Legislation

The GOP-led House is expected to vote Wednesday on the legislation resulting from a compromise between House Speaker Kevin McCarthy and President Joe Biden on the debt limit.

Read MoreMcCarthy-Biden Debt Deal Eliminates Unspent COVID Funds, Blocks IRS Expansion and Reforms Permitting

The debt limit deal struck late Saturday between House Speaker Kevin McCarthy and President Joe Biden rolls back some of Washington’s massive spending while delivering other conservative priorities like blocking new taxes and requiring some welfare recipients to work, according to a summary obtained by Just the News.

McCarthy described the deal as an “agreement in principle,” and it rolls back domestic spending to fiscal year 2022 levels while limiting “top line federal spending to 1% growth for the next 6 years.”

Read MoreMcCarthy Says Debt Deal Will Require Spending Cuts

U.S. House Speaker Kevin McCarthy said Wednesday that the White House must agree to spending cuts as part of a debt deal.

“You have to spend less than you did last year,” McCarthy said at a news conference. “That’s not that difficult to do, but in Washington, somehow, that is a problem.”

Read MoreCommentary: Any Debt ‘Default’ Will Be Biden’s Choice

There’s enough revenue to pay interest on the debt even if the $31.4 trillion debt ceiling is reached.

Meaning, if the U.S. defaults on the debt on June 1, it will be because President Joe Biden chose not to make principal and interest payments on U.S. Treasuries out of existing revenue, for which there is more than ample revenues to service and refinance up to the current debt ceiling limit, $31.4 trillion.

Read MoreU.S. Faces ‘Significant Risk’ of Breaking Debt Ceiling in First Weeks of June: CBO

The U.S. government faces a significant risk of not being able to pay its bills in the coming weeks without an increase to the debt limit, the Congressional Budget Office said Friday.

The warning comes as Democrats and Republicans remain far apart on negotiations over the debit limit. The debt ceiling is the maximum amount of debt the U.S. Department of the Treasury can issue.

Read MoreWhite House Aiming for Two-Year Deal on Debt Ceiling as Talks Stall: Report

White House staff are reportedly pushing a deal on the debt ceiling as talks between House Speaker Kevin McCarthy and President Joe Biden on a potential raise of the debt limit have been delayed.

The White House is seeking a debt-ceiling increase that would push back the borrowing limit by two years, according to Politico. In exchange, they are reportedly agreeing to caps on “discretionary” spending, which refers to all congressional appropriations excluding Medicare, Medicaid, and Social Security and some minor programs, according to Politico.

Read MoreCommentary: U.S. Government Will Not Default on Loans If Congress Doesn’t Raise the Debt Ceiling

Contrary to widespread claims that the U.S. government will default on its debt if Congress doesn’t raise the debt limit, federal law and the Constitution require the Treasury to pay the debt, and it has ample tax revenues to do this.

Nor would Social Security benefits be affected by a debt limit stalemate unless President Biden illegally diverts Social Security revenues to other programs.

Read MoreCommentary: Joe Biden Gambles on Default with No-Strings Increase of $31 Trillion Debt Ceiling

President Joe Biden is set to meet with House Speaker Kevin McCarthy (R-Calif.) and other Congressional leaders on May 9 to discuss the looming the $31.4 trillion debt ceiling. It’s about time.

So far, Biden’s only plan has been for Congress to simply increase it into perpetuity or else threaten to default, never bothering to address the dismal fiscal outlook facing the nation, even as regional banks continue to fail because of the unsustainable burden caused by taking on U.S. treasuries — a problem that will only grow as the White House Office of Management and Budget (OMB) projects the national debt will rise to $50.7 trillion by 2033.

Read MoreFiscal Hawks Warn Biden: No Debt Ceiling Deal Without Fiscal Reforms

The fiscal hawks are sticking to their guns. On Friday, Sens. Ron Johnson (R-WI) and J.D. Vance (R-OH) joined 22 of their fellow Republican senators in a letter warning President Joe Biden that they will not vote for increasing the debt ceiling without structural reforms to the federal government’s budget and debt problems.

Read MoreConservative Senators Demand Spending Cuts, Fiscal Reform in Debt Ceiling Deal

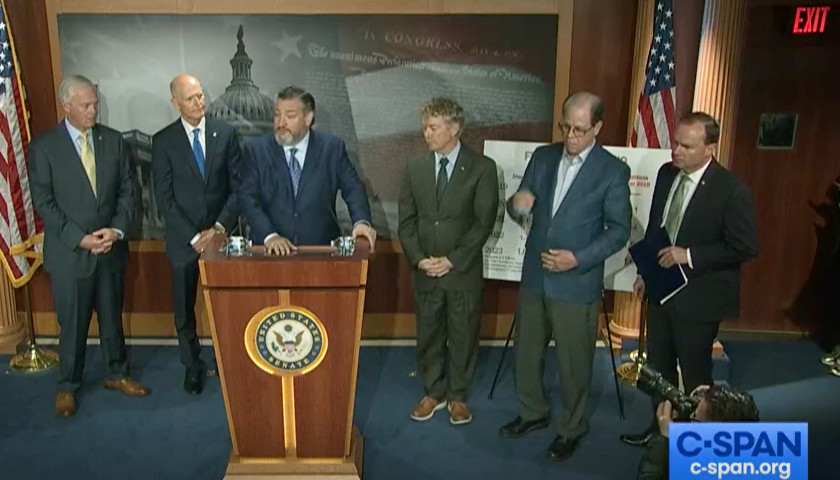

Fiscal hawks in the Senate reiterated their demands for fiscal reforms and spending cuts Tuesday as they voiced their support for House Republicans to lead the heavy-lifting on addressing the nation’s debt ceiling crisis. “We have an opportunity to stop the madness, and it’s incumbent on the Republican majority in the House and Republicans in the Senate to use every lever point we have,” said Sen. Ted Cruz (R-TX) at a press conference on the debt ceiling and runaway spending.

Read MoreGOP Lawmaker Floats Mechanism to Default Spending to Current Levels to Avert Debt Ceiling Crises

With the nation stuck at its $31.38 trillion debt limit and the Department of the Treasury imposing “extraordinary measures” to keep the government running, one GOP lawmaker is floating a new proposal to default federal spending to current levels to avert recurring standoffs over raising the debt ceiling.

Read MoreU.S. Hits $31.4 Trillion Debt Ceiling as Treasury Announces ‘Extraordinary Measures’ to Avoid Default

The United States reached its debt ceiling of $31.38 trillion on Thursday, forcing the Treasury Department to implement “extraordinary measures” to avoid defaulting on bonds. Treasury Secretary Janet Yellen wrote how the U.S. had reached the debt limit in a letter Thursday to members of Congressional leadership.

Read MoreTennessee Star National Political Editor Neil McCabe Talks Build Back Better Bill and Nancy Pelosi’s Future

Wednesday morning on the Tennessee Star Report, host Michael Patrick Leahy welcomed National Political Editor for The Tennessee Star Neil McCabe to the newsmakers line to weigh in on the status of the Build Back Better bill and the fate of Nancy Pelosi.

Read MoreSenate Clears Way for Democrats to Lift the Debt Ceiling After Agreement Between Schumer, McConnell

A bill that would enable Democrats to raise the debt ceiling without overcoming a Senate filibuster passed the chamber Thursday afternoon with bipartisan support.

The debt ceiling provisions were attached to a bill that prevents automatic cuts to Medicare. Ironically, the legislation, which passed the House on near party lines Tuesday, required 60 votes to overcome a filibuster, and passed after 14 Republicans joined Democrats in advancing it.

The provision was the product of a deal struck Tuesday between Senate Majority Leader Chuck Schumer and Minority Leader Mitch McConnell. Under it, Congress would pass a law allowing the debt ceiling to be raised with a simple majority this one time, and the bill’s passage puts the limit on a glade path to be lifted by Democrats alone ahead of Dec. 15, when Treasury Secretary Janet Yellen warned a default could occur.

Read MoreRetail Sales Beat Expectations Amid Surging Inflation

U.S. retail sales increased in September, beating expectations amid growing inflation and supply chain disruptions, the U.S. Census Bureau reported Friday.

Retail sales increased 0.7% in September, beating experts’ estimates of 0.2%, according to the Census Bureau report. The number rose 0.8%, excluding auto sales, beating the 0.5% forecast.

Sales were up 13.9% compared to September 2020, and they increased 15.6% compared to September 2020, excluding auto sales, according to the Census Bureau.

Read MoreManchin Condemns Schumer’s GOP Bash After Parties Compromise on Debt Limit, Says ‘Civility Is Gone’

West Virginia Sen. Joe Manchin was once again at odd with his party Thursday evening, as fellow Democrat and Senate Majority Leader Chuck Schumer laid into his GOP colleagues during a floor speech following a vote to approve legislation that would temporarily raise the debt ceiling.

“Republicans played a dangerous and risky partisan game, and I am glad that their brinksmanship did not work,” said Schumer, beginning a series of remarks that would target his colleagues across the aisle, including 11 of whom voted to end debate on the debt ceiling measure, allowing for the full vote to happen.

Manchin, who could be seen seated direct behind Schumer, as the New York lawmaker made his remarks, appeared at first to be shaking his head disapprovingly before placing his head in his hands.

Read MoreSchumer: Congress Must Raise Debt Ceiling This Week

Senate Majority Leader Chuck Schumer told his caucus Monday that Congress must pass a bill to raise the debt ceiling this week.

“Let me be clear about the task ahead of us,” Schumer said. “We must get a bill to the President’s desk dealing with the debt limit by the end of the week. Period.”

Read MoreYellen: U.S. Will Be out of Money in October If Congress Doesn’t Raise Debt Ceiling

Treasury Secretary Janet Yellen warned congressional leaders Wednesday that the U.S. is on track to default on its debt sometime in October if Congress fails to raise the debt ceiling.

Yellen said the Treasury would likely run out of cash in the coming weeks and exhaust its “extraordinary” spending measures to keep the country within its legal borrowing limit.

Read MoreJanet Yellen Warns of ‘Irreparable Harm’ If Congress Doesn’t Raise the Debt Ceiling

Treasury Secretary Janet Yellen warned congressional leaders Friday that failing to raise the debt ceiling would risk “irreparable harm to the U.S. economy and the livelihoods of all Americans.”

In a letter, Yellen said that she did not know how long the Treasury Department could prevent the U.S. from defaulting on its debt, which could carry catastrophic economic consequences. The debt ceiling is set to expire on Aug. 1.

Read MoreU.S. Set to Hit Debt Ceiling Within Four Months, Congressional Budget Office Estimates

The federal government is on track to reach the statutory debt limit in the fall, which would trigger a government shutdown, according to a Congressional Budget Office (CBO) estimate.

The U.S. is projected to reach the debt ceiling of $28.5 trillion by October or November, a CBO report released Wednesday stated. If Capitol Hill lawmakers don’t reach an agreement on raising the limit higher, the government could undergo its third shutdown in less than four years.

“If the debt limit remained unchanged, the ability to borrow using those measures would ultimately be exhausted, and the Treasury would probably run out of cash sometime in the first quarter of the next fiscal year (which begins on October 1, 2021), most likely in October or November,” the CBO report said.

Read More