The Internal Revenue Service on Tuesday announced roughly $1 billion in penalty relief to those owing back taxes from 2020 and 2021, during the height of the COVID-19 pandemic.

Read MoreTag: taxes

As Joe Biden Promised Tax Fairness, His Son Rushed to Erase His Delinquent Taxes, IRS Memos Show

As Joe Biden marched toward the presidency in 2020 with a promise to force the wealthy to pay their “fair share” of taxes, his son Hunter was scrambling behind closed doors to clean up a trail of his own delinquent taxes before they became an election scandal, according to once-secret IRS memos made public recently by Congress.

IRS agents would soon discover that the future first son was continuing to allegedly misrepresent his income and deductions to the very accountant he had hired to help, the memos show.

Read MoreCommentary: The New Right Cares About More than Taxes

New research is challenging assumptions about the Republican Party’s core values, showing the GOP of the 2020s is an entirely different animal from the GOP of the 2010s. The research captures an increasing shift toward populism and America First priorities that has been growing since Former President Trump’s election in 2016.

The study by American Compass divides Republicans into two camps, the Old Right and the New Right, based on their economic priorities and approach to cultural issues.

Read MoreCommentary: Tax Relief Is Coming to Millions of Red-State Residents in Ohio, Connecticut, and More

July marked the beginning of Fiscal Year 2024 for 46 of the 50 states. It also closes the books on most state legislative sessions in what was an incredible 2023 for hard-working taxpayers.

In recent years, we’ve seen significant income tax relief in the states. Notably, 10 states – Kentucky, West Virginia, Montana, Utah, Arkansas, North Dakota, Indiana, Nebraska, Connecticut, and Ohio – have cut personal income taxes (PIT) in 2023. With the new addition of West Virginia, North Dakota, and Connecticut, 22 states have cut personal income taxes since 2021, with several of these states cutting taxes multiple times during that period.

Read MoreCommentary: The Surprising Origins of the ‘No Taxation Without Representation’ Slogan

Ask most Americans where the slogan “No taxation without representation!” came from and the likely response will be “American colonists protesting against Britain in the 1760s.” But the spirit, if not the precise letter of the phrase, originated more than a century before. Moreover, we can thank the Brits themselves for it. It started with something called the “ship tax.”

Since the early Middle Ages, English custom allowed the monarch to impose a special levy in times of war upon citizens who lived in coastal settlements. They could meet the requirement by providing ships, shipbuilding materials, or money for the Crown to build ships (hence the name, “ship tax”). Kings and Queens levied the “tax” as a royal prerogative, meaning they skipped the annoyance of securing the consent of Parliament as required in the Magna Carta of 1215.

Read MoreCommentary: The Bidens’ Existential Threats to the American Rule of Law

President Joe Biden, the Biden grifting conglomerate, the Department of Justice, and the FBI under its fourth consecutive weaponized director, are in danger of subverting the American system of law.

They are in various ways undermining the tradition of self-reported income tax computation and voluntary compliance.

Read MoreIRS Whistleblower: Hunter Biden Hasn’t Paid Taxes on 2014 Money from Ukrainian Oligarch’s Firm

Federal agents secured evidence that Hunter Biden engaged in a “pretty classic tax evasion scheme” that allowed him to avoid paying taxes on millions of dollars in income since at least 2014, and the deal he ultimately got would not have been afforded to other Americans facing such serious charges, an IRS whistleblower who supervised the investigation tells Just the News.

“If these facts were from the local businessman or the neighbor next door, they would have been charged, they would have already probably had their entire sentence,” IRS Supervisor Agent Gary Shapley said during a 45-minute interview aired Thursday on the John Solomon Reports podcast.

Read MoreFeds Built Case Hunter Biden Evaded $2.2 Million in Taxes Dating to 2014 Before Being Thwarted

If Hunter Biden pleads guilty next month as expected to two misdemeanor tax evasion charges, he’ll be admitting he shorted the U.S. government of about $100,000 in taxes he owed in 2017-18.

But it’s a far cry from the evidence the IRS and FBI developed showing a pattern of tax evasion and avoidance that stretched back to his father’s term as vice president a decade ago, according to newly released documents and testimony.

Read MoreRamaswamy: Plea Deal Keeping Hunter Biden out of Prison Is a ‘Joke,’ the ‘Perfect Fig Leaf’

GOP presidential candidate Vivek Ramaswamy is blasting a plea deal announced Tuesday that will keep President Joe Biden’s troubled son out of prison on two federal misdemeanor counts of failing to pay his taxes and a separate felony charge of possession of a firearm by a known drug user.

Read MoreProperty Taxes Climb 3.6 Percent Across U.S. to $339.8 Billion

Property taxes levied on single-family homes in the United States increased 3.6 percent to $339.8 billion in 2022, according to a new report from a real estate data firm.

That’s up from $328 billion in 2021. The 2022 increase was more than double the 1.6 percent growth in 2021, but smaller than the 5.4 percent increase in 2020, according to the report from ATTOM, a property data provider.

Read MorePoll: 73 Percent of Taxpayers Say Government Doesn’t Use Their Taxes Wisely

Ahead of Tax Day on April 18, 73% of taxpayers said the government doesn’t use their taxes wisely, a new survey found. A separate report found that red states have the better taxpayer return on investment.

Wallethub’s “Taxpayer Survey” found that 28% of respondents said charities would better spend their money; 26% said local governments would best spend their money, followed by state government (22%), the federal government (16%) and religious groups (13%).

Read MoreCommentary: States Raising Taxes on the Rich Should Expect a Line at the Exit

It’s an old aphorism that if you tax something, you get less of it. Seven states are at risk of finding out exactly how that truism applies to wealth tax legislation introduced in each should their proposed taxes become law.

Read MoreMinnesota Ranks in the Top Five States for Cigarette Smuggling

A new study released by The Tax Foundation this week reports high tax rates on cigarettes induce smuggling of tobacco products from low-tax states or foreign sources into high-tax states.

“States and municipalities have spent millions to combat cigarette smuggling. Recent policy responses include greater law enforcement activity on interstate roads, differential tax rates near low-tax jurisdictions, banning common carrier delivery of cigarettes, and cracking down on tribal reservations that sell tax-free cigarettes,” the “Cigarette Taxes and Cigarette Smuggling by State, 2020” report said. “However, the underlying problem persists. High cigarette taxes act similarly to a ‘price prohibition’ on the legal product in many U.S. states, incentivizing smuggling and illicit activity.”

Read More13 States May Tax Canceled Student Loans

Borrowers in thirteen states who have student debt canceled under the Biden administration’s plan may still be taxed hundreds of dollars next year on their forgiven loans.

Read MoreCommentary: Long-Term Study Finds That Higher Corporate and Personal Taxes Lower Real GDP

by Ross Pomeroy One of the main planks of President Biden and congressional Democrats’ agenda is making corporations and high-earning Americans “pay their fair share” through higher taxes. But a recently published analysis in the journal SAGE Open delving into sixty years of U.S. economic data from 1960 to 2020 suggests that their…

Read MoreTrump: ‘America Is on the Edge of an Abyss’

Donald Trump on Saturday delivered stinging rebukes of the Biden administration at the Dallas Conservative Political Action Conference, one of a continuing series of indications that the still-popular former president has set his sights on a return to the White House for 2024.

Trump during his speech declared that the U.S. “is being destroyed more from the inside than the out,” and that the country “is on the edge of an abyss, and our movement is the only force on earth that can save it.”

Read MoreCommentary: Yes, Taxes Can Drive People to Move

Many people will tell that people choose to live somewhere based on factors like the weather or proximity to family, and that taxes don’t enter into the equation. While there is a lot of truth to that understanding, when taxes reach a certain point, they can cause people to alter their behavior. Have you heard of voting with your feet? Here’s how that exact concept is playing out for two Iowa families.

Read MoreGov. Walz Offers Minnesotans $1,000 Checks to Spend Half of $9.2 Billion Surplus

Gov. Tim Walz suggested sending half of the state’s $9.2 billion surplus back to taxpayers in a 15-minute special session.

Walz last weekend proposed sending individuals $1,000, and married couples $2,000.

Only Walz can call a special session, but he hasn’t after a GOP and DFL broad deal for $4 billion in tax relief and $4 billion in savings disintegrated in May as the regular session concluded.

Read MoreIRS Warns Taxpayers of Potential Scams in New ‘Dirty Dozen’ List

The Internal Revenue Service is warning taxpayers of several tax scams.

The scams cover four transactions involving charitable remainder annuity trusts, Maltese individual retirement arrangements, foreign captive insurance, and monetized installment sales.

Read MoreCommentary: The Tax Increase That’s Hidden in Plain Sight

Americans have less money than they had last year — though taxes haven’t been raised. So what’s the problem? Inflation, which has increased at a 40-year high annual pace of 7.9%. It acts as a hidden tax because we don’t see it listed on our tax bills, but we sure see less money on our bank accounts.

In fact, inflation-adjusted average hourly earnings for private employees are down about 2.5% over the last year. This means a person with $31.60 in earnings per hour is buying 2.5% less of a grocery basket purchased just last year. “For a typical family, the inflation tax means a loss in real income of more than $1,900 per year,” stated Joel Griffin, a research fellow at The Heritage Foundation.

Read MoreBiden Unveils $5.8 Trillion Budget Proposal with Increased Taxes on Businesses, Wealthy Individuals

President Joe Biden unveiled a new 2023 budget proposal Monday along with major tax increases to help pay for it.

Biden’s budget, which comes in at about $5.8 trillion, is not expected to become law, but presidential budgets help set the legislative priorities for the year to come.

Read MoreWith Gas Prices at Historic Highs, Biden Calls for Raising Taxes on Oil Drillers

President Joe Biden’s budget proposes to scrap more than $45 billion in fossil fuel subsidies, his administration’s latest attack on the beleaguered industry.

The White House budget will remove more than a dozen fossil fuel industry tax credits, increasing the federal government’s revenue by an estimated $45.2 billion between 2023-2032, according to the proposal published Monday. The administration explained that the proposal was written to prevent further fossil fuel investment.

Read MoreMinnesota Republicans Continue Calls for Tax Cuts amid Budget Surplus

Republicans in the Minnesota Senate continue to push their proposal to cut taxes in the state, pointing to the $9 billion surplus the state has amassed.

However, the forecast warned that “inflation and geopolitical conflict pose risk to the budget and economic outlook.”

Read MoreCommentary: The IRS Can’t Get the Basics Right, So Don’t Add to Its Authority

All taxpayers are dealing with a disastrous filing season this year, with the IRS backed up on processing millions of returns and refunds from last year and communication from the agency nonexistent at best. But some taxpayers will have an added headache in the future as a result of an unnecessary new paperwork requirement that went into effect this year. Fortunately, however, legislation introduced by Sen. Bill Hagerty (R-TN) would address this issue by removing the burdensome new requirement.

Ever since IRS Commissioner Chuck Rettig claimed last year that the “tax gap,” or the gap between what the IRS collects and what it believes it is owed, could be as large as $1 trillion, politicians and legislators have been scrambling to propose ways to collect all that missing revenue. That’s despite the fact that more sober analyses show that the $1 trillion figure is probably wildly exaggerated, that it is functionally impossible to wholly prevent tax evasion, and that a far greater concern is the IRS’s inability to handle its taxpayer service responsibilities.

But as far as proposals to collect all this supposed “extra revenue” go, most of the focus has rightly been on schemes to drastically increase the IRS’s enforcement budget and allow the IRS to snoop on taxpayers’ financial accounts. But another more targeted change has already gone into effect, and is already causing problems.

Read MoreMinnesota Senators Pass Unemployment Insurance Trust Fund Bill

A bill to repay Minnesota’s federal Unemployment Insurance Trust Fund passed the Senate Monday and it will now travel to the House for consideration.

The bill, SF 2677, appropriates $2.3 billion from the state fiscal recovery federal fund and $408.5 million from the fiscal year 2022 general fund to the commissioner of employment and economic development.

The commissioner would repay the federal government outstanding loans and accrued interest within 10 days of the bill’s enactment. For the 2022 and 2023 calendar years, the base tax rate would be one-tenth of one percent.

Read MoreIRS Reverses Plans for Facial Recognition Software on Its Website

On Monday, the Internal Revenue Service (IRS) announced in a statement that it would no longer be moving forward with previous plans to implement a controversial facial recognition software on its website in order for users to access certain tax records.

According to CNN, the IRS’s reversal came after widespread backlash by elected officials, privacy groups, and others who pointed out that such technology would constitute a massive overreach and violation of individual privacy. The IRS said in its statement that it would “transition away from using a third-party verification service involving facial recognition,” and would instead add an “additional authentication process.” The agency also vowed to “protect taxpayer data and ensure broad access to online tools.”

“The IRS takes taxpayer privacy and security seriously,” IRS commissioner Chuck Rettig said, “and we understand the concerns that have been raised. Everyone should feel comfortable with how their personal information is secured, and we are quickly pursuing short-term options that do not involve facial recognition.”

Read MoreCommentary: The GOP Can Reclaim the Child Tax Credit – And Use it to Win in 2022

As part of his Contract with America, House Speaker (and my former boss) Newt Gingrich helped first introduce the Child Tax Credit (CTC), passing it in 1997. Originally the idea of President Ronald Reagan, the CTC was founded on the conservative principles that raising children is God’s work, and parents should not be punished or held back for choosing family in a country that is always moving forward. President Trump continued this tradition by doubling the CTC in 2017. As Speaker Gingrich said during a 1995 speech, “We believe that parents ought to have the first claim on money to take care of their children rather than bureaucrats.”

Democrats reformed the CTC in 2021, as part of their wildly overdone American Rescue Plan. They’ve sought to continue their changes to the CTC in the even-more-overdone Build Back Better Act (BBB), a hulking Frankenstein of bad Democratic ideas. But the new version of the CTC may be an exception. It continues fulfilling Speaker Gingrich’s contract, empowering families to work and earn, and to raise their children with their own values. The spirit and core of that policy is even better reflected by flat, poverty-busting monthly disbursement of the credit. It’s the only salvageable ship in the sinking BBB fleet.

The CTC – in its 2021 form – does not stray too far from the $500-per-child tax cut that was initially passed in 1997. The payments, which provided eligible families with up to $300 per month for each qualifying child under age 6 and up to $250 per month for each qualifying child aged 6 to 17, stimulated regional economies, protected families from rising costs, provided direct cash relief, and removed bureaucratic hurdles.

Read MoreCommentary: We Can’t Split the Difference on Culture

The United States is an outlier among established democracies in two respects: We face both falling social trust and rising polarization. I have argued that the two dynamics connect in a doom loop. Trust in others and institutions falls, leading to greater polarization, which drives trust down even more. That is why the two processes are getting worse at the same time. A nasty dynamic has taken hold in the country, and it regularly affects all of us.

Many issues polarize us, but we should prefer polarization on economics to polarization on culture. Polarization is least damaging on issues most amenable to “splitting the difference”—as many economic issues are.

Consider taxes. Progressives want higher taxes on the rich, while conservatives want lower taxes. The possibility of compromise always exists—and even if it is obscured beneath the surface of our political tempers, uncovering it is not hard. For example, we could average our preferred tax rates, and no one would come away emptyhanded. Granted, that’s not how we have handled this issue in the past, but it’s at least conceivable.

Read MoreKansas Lawmakers Reveal Draft Bill to Eliminate the Food Tax

Kansas Gov. Laura Kelly and the Legislature’s Democratic leadership on Thursday released a draft bill to get rid of the food sales tax in the state.

Known colloquially as the “Axe the Food Tax” bill, the legislation would eliminate the state’s 6.5% sales tax on food. The draft bill also includes a full exemption on state and local taxes for items bought at farmers markets.

Senate Minority Leader Dinah Sykes, D-Lenexa, and House Minority Leader Tom Sawyer, D-Wichita, helped craft the legislation and are formally looking for co-sponsors.

Read MoreManchin Reportedly Told the White House He Supports a Billionaire Tax

West Virginia Democratic Sen. Joe Manchin told the White House last week that he was willing to endorse some type of billionaire tax in President Joe Biden’s domestic spending package before coming out against it days later, The Washington Post reported.

Manchin said that a tax on billionaires’ wealth could be a means to pay for the package, according to the Post, citing three people familiar with his offer to the White House. The outlet reported that it was unclear whether Manchin provided an estimate of how much money the provision would raise.

Programs in Manchin’s $1.8 trillion counteroffer included universal pre-K for ten years, expansions to the Affordable Care Act and billions of dollars for climate change mitigation measures, according to the Post, but it did not include the child tax credit, which many Democrats have touted as one of the single biggest policy achievements of the year.

Read MoreCommentary: When Envy Trumps Economics

President Joe Biden has seized on a winning message: tax the rich. He tweets incessantly, “Big corporations and the super wealthy have to start paying their fair share of taxes. It’s long overdue,” and claims his Build Back Better agenda “will be paid for by the wealthy paying their fair share.”

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Younger Millennials and Gen Z: Being Rich Is Inherently Bad

A recent PEW research poll revealed that half of adults under 30 believe billionaires are bad for the U.S. One self-proclaimed “anticapitalist” Millennial and trust fund beneficiary summed it up this way: “I want to build a world where someone like me, a young person who controls tens of millions of dollars, is impossible.” Accordingly, wealth comes from exploitation. Giving their money away (or giving it to Washington to redistribute into a social justice plan) is making “reparations.”

Using this logic, the late Steve Jobs should have been prohibited from earning ridiculous amounts of wealth. Because of his ingenuity, however, millions of jobs have been created, young people have been inspired, and some of the greatest technology has been made available. Like Jobs, those who earn their billions through innovation (and experience many failures in their pursuit and on their own dime) reinvest it in the economy in ways the government could not. Moreover, their earnings are a result of what others were willing to pay them.

Working Rich: We’re Moral People

A 2019 letter penned by more than a dozen of the wealthiest Americans — including George Soros, heiress Abigail Disney, and Molly Munger, daughter of Berkshire Hathaway Vice Chairman Charlie Munger— stated, “it is our duty to step up and support a wealth tax that taxes us.” They believe America “has a moral, ethical and economic responsibility to tax our wealth more.” Mr. Biden’s allies on the Left share this opinion.

A “transfer of wealth” by taxing the rich is nothing short of legal theft. Government is not, and cannot be, altruistic. Government has nothing to give that it has not taken from another by force. With few exceptions, this type of help will erode self-reliance and the moral incentive of charitable action, leading to more government spending.

Ignored is that the free market has done more to break the cycle of poverty than any government program, as it empowers people and mends the nonfinancial, relational parts of society.

The wealthy could put their money to better use by directly donating to effective charitable causes, investing in local communities, or investing in expanding their businesses to serve more consumers and create more jobs. Moreover, there is nothing stopping billionaires from giving their wealth directly to the U.S. government. If they genuinely believe it is their “moral, ethical and economic responsibility,” there is no need to wait.

Governing Elites: We Like Being In Control

They say it’s about social or economic justice, but President Biden’s messaging is déjà vu from Obama-era calls to redistribute wealth, or Marxist accolades of redistribution as a form of economic justice. The increasing popularity of taxing the rich makes the job of government elites easier. President Biden even engages in shame-tweeting such as, “Those at the top have been getting a free ride at the expense of the middle class for far too long.” But the bureaucrats’ real reason to tax the rich is to snatch individuals’ birthrights of personal responsibility, a move toward a centralized system that deflates personal choices and violates personal rights.

Taken together, these ideas unfortunately resonate beyond younger millennials and Gen Z, the working rich, and the governing elites. Jumping onto the “tax the rich” bandwagon feels good because – why should the rich have that much money anyway?

Envy permeates this ideology. Yet economics trumps envy.

The actual tax burden will not fall on folks writing checks to the US Treasury. The rich will, for the most part, still be rich. It’s the middle- and working class who will pay dearly when high-income individuals respond to the tax hike by simply investing less, resulting in fewer job opportunities and lower wages.

Left to fend for their economic lives will be small-business owners. President Biden may consider them wealthy, but taxing these individuals more will decimate communities, as jobs are lost or not created, and wages and hours are cut.

There’s no question that taxing the rich is popular. Problem is, it’s also reckless.

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Commentary: When Envy Trumps Economics

President Joe Biden has seized on a winning message: tax the rich. He tweets incessantly, “Big corporations and the super wealthy have to start paying their fair share of taxes. It’s long overdue,” and claims his Build Back Better agenda “will be paid for by the wealthy paying their fair share.”

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Younger Millennials and Gen Z: Being Rich Is Inherently Bad

A recent PEW research poll revealed that half of adults under 30 believe billionaires are bad for the U.S. One self-proclaimed “anticapitalist” Millennial and trust fund beneficiary summed it up this way: “I want to build a world where someone like me, a young person who controls tens of millions of dollars, is impossible.” Accordingly, wealth comes from exploitation. Giving their money away (or giving it to Washington to redistribute into a social justice plan) is making “reparations.”

Using this logic, the late Steve Jobs should have been prohibited from earning ridiculous amounts of wealth. Because of his ingenuity, however, millions of jobs have been created, young people have been inspired, and some of the greatest technology has been made available. Like Jobs, those who earn their billions through innovation (and experience many failures in their pursuit and on their own dime) reinvest it in the economy in ways the government could not. Moreover, their earnings are a result of what others were willing to pay them.

Working Rich: We’re Moral People

A 2019 letter penned by more than a dozen of the wealthiest Americans — including George Soros, heiress Abigail Disney, and Molly Munger, daughter of Berkshire Hathaway Vice Chairman Charlie Munger— stated, “it is our duty to step up and support a wealth tax that taxes us.” They believe America “has a moral, ethical and economic responsibility to tax our wealth more.” Mr. Biden’s allies on the Left share this opinion.

A “transfer of wealth” by taxing the rich is nothing short of legal theft. Government is not, and cannot be, altruistic. Government has nothing to give that it has not taken from another by force. With few exceptions, this type of help will erode self-reliance and the moral incentive of charitable action, leading to more government spending.

Ignored is that the free market has done more to break the cycle of poverty than any government program, as it empowers people and mends the nonfinancial, relational parts of society.

The wealthy could put their money to better use by directly donating to effective charitable causes, investing in local communities, or investing in expanding their businesses to serve more consumers and create more jobs. Moreover, there is nothing stopping billionaires from giving their wealth directly to the U.S. government. If they genuinely believe it is their “moral, ethical and economic responsibility,” there is no need to wait.

Governing Elites: We Like Being In Control

They say it’s about social or economic justice, but President Biden’s messaging is déjà vu from Obama-era calls to redistribute wealth, or Marxist accolades of redistribution as a form of economic justice. The increasing popularity of taxing the rich makes the job of government elites easier. President Biden even engages in shame-tweeting such as, “Those at the top have been getting a free ride at the expense of the middle class for far too long.” But the bureaucrats’ real reason to tax the rich is to snatch individuals’ birthrights of personal responsibility, a move toward a centralized system that deflates personal choices and violates personal rights.

Taken together, these ideas unfortunately resonate beyond younger millennials and Gen Z, the working rich, and the governing elites. Jumping onto the “tax the rich” bandwagon feels good because – why should the rich have that much money anyway?

Envy permeates this ideology. Yet economics trumps envy.

The actual tax burden will not fall on folks writing checks to the US Treasury. The rich will, for the most part, still be rich. It’s the middle- and working class who will pay dearly when high-income individuals respond to the tax hike by simply investing less, resulting in fewer job opportunities and lower wages.

Left to fend for their economic lives will be small-business owners. President Biden may consider them wealthy, but taxing these individuals more will decimate communities, as jobs are lost or not created, and wages and hours are cut.

There’s no question that taxing the rich is popular. Problem is, it’s also reckless.

Instead of highlighting the few benefits of his Build Back Better Act, (H.R. 5376) his public positioning is about harming a particular group. Why? This message sells with three key constituencies he’s counting on to pressure Congress to vote yes.

Younger millennials and Gen Z who believe the uber-rich should not exist.

The working rich who believe taxing themselves is a solution to poverty and a source of economic growth.

The governing elites who want to accumulate more government control by enlarging the dependent class.

Newt Gingrich Commentary: Abolish the Georgia State Income Tax

The time has come to abolish the Georgia state income tax.

Sen. David Perdue was exactly right in proposing to eliminate the state income tax. He was also right in suggesting that he could work with the Georgia state legislature and find ways to return money to the people of Georgia rather than focusing it on the state bureaucracies.

The money is clearly there. The Atlanta Journal Constitution reported, “Despite pandemic, Georgia ends fiscal year with a record $3.2 billion jump in revenue.” The article went on to note, “The state saw revenue grow 13.5% over 2020. … Besides the boon in state tax collections, Georgia is also receiving about $4.7 billion or so from the latest federal COVID-19 relief plan.”

Read MoreCommentary: Youngkin Shock Win in Virginia Vote of No Confidence in Biden, Portends Red Wave for GOP in Congress in 2022

This is one of the greatest votes of no confidence in the 21st Century.

Against the destructive policies of President Joe Biden, a torrent of spending that has brought back memories of the 1970s — surging inflation as the middle class are taxed their savings at the grocery store and then scenes of American defeat overseas in Afghanistan that stranded hundreds of Americans and thousands of American allies, who now suffer under the tyranny of the Taliban.

Read MoreCommentary: Taking the Infrastructure Bill Hostage Didn’t Work

Back in August, New York magazine’s Jonathan Chait blessed the strategy of the Congressional Progressive Caucus to withhold their votes for the Senate’s bipartisan physical infrastructure plan until that bill was effectively linked to a bigger, broader, and surely partisan, measure investing in a range of items from climate protection to universal preschool. He argued that “ransoming the infrastructure bill” would turn the tables on the party’s moderates:

Historically, most partisan bills are shaped by the preferences of the members of Congress closest to the middle, and their colleagues on the political extreme simply have to go along with it. … This time, the left has real power. Progressives can credibly threaten to sink a priority that moderates care about more than they do.

Twice in the past two months, most recently last Thursday, the House progressives successfully executed this strategy, blocking attempts by Speaker Nancy Pelosi to pass the bipartisan infrastructure legislation before an agreement is reached on the larger “Build Back Better” bill.

Read MoreU.S. Consumer Spending Grew Slowly in September amid High COVID-19 Cases, Supply Chain Problems and Rising Inflation

U.S. consumer spending growth slowed in September, and income dropped due to high COVID-19 cases, supply shortages, rising inflation, and ending unemployment benefits.

Consumer spending increased 0.6% in September, down from a 1% jump in August, the Commerce Department announced Friday. Personal income fell 1% in September, driven by a 72% drop in unemployment insurance benefits that offset a 0.7% spike in wages and benefits, according to The Wall Street Journal.

Economists polled by Reuters projected a 0.5% in consumer spending. Delta variant cases peaked in the middle of September, and the continued supply chain backups have caused shortages and rising prices, making it harder for consumers to purchase their desired goods, the WSJ reported.

Read MoreManchin Reportedly Outlines Demands for Democrats’ Climate Change, Child Tax Credit Plan

Democratic Sen. Joe Manchin of West Virginia reportedly opposed two pieces of his party’s spending package as negotiations over its price tag and reach continue to stall.

Democratic Sen. Joe Manchin of West Virginia’s opposition reportedly relates to the Democrats’ climate change and child tax credit provisions of the budget proposal. While the majority of his party lauded both programs, the 50-50 Senate means that any one Democratic senator could tank the bill, giving Manchin veto-like power while representing a rural, coal-producing state that voted for former President Donald Trump by almost 40 points in 2020.

Multiple reports surfaced Friday suggesting that the Clean Electricity Payment Program would likely be scrapped from the bill due to Manchin’s objections, part of Democrats’ attempt to fight climate change. Those backing the program, which would provide incentives for clean energy use while implementing fines and penalties for organizations continuing to rely on fossil fuels, see it as a fundamental piece of the Democrats’ agenda and key to reaching President Joe Biden’s goal of reducing U.S. emissions by 50% of what they were in 2005 by 2030.

Read MoreDemocrats’ Budget Set to Include Global Minimum Tax, Treasury Secretary Says

Treasury Secretary Janet Yellen said Sunday that she is confident that the Democrats’ budget will include a global minimum tax for corporations just days after nearly 140 countries endorsed the measure.

“I am confident that what we need to do to come into compliance with the minimum tax will be included in a reconciliation package,” Treasury Secretary Janet Yellen told ABC News on Sunday. “I hope that it will be passed and we will be able to reassure the world that the United States will do its part.”

Though the United States and 135 other countries signed the agreement, each nation must pass its own legislation to enact the minimum tax rates. Democrats are currently crafting the budget, a spending package that would reshape the social safety net, but the process has slowed by disagreements between the party’s moderate and left wings.

Read MoreRepublican Leaders Push Back Against Global Business Tax

Republican lawmakers are pushing back against the Biden administration’s plan to join a global compact implementing a tax on U.S. corporations regardless of where they operate.

One hundred and thirty six136 countries agreed Friday to implement a global business tax, and G-7 finance leaders agreed to the plan Saturday. President Joe Biden and Treasury Secretary Janet Yellen praised the plan.

Proposed by the Paris-based Organization for Economic Co-operation and Development (OECD), an intergovernmental economic organization, the global tax is necessary to respond to an “increasingly globalized and digital global economy,” OECD said.

Read MoreCommentary: Bearing the Tax Burden of the Biden Administration

As congressional Democrats push a $3.5 trillion social spending package, everyone is wondering: “How are we going to pay for that?” To President Joe Biden, the answer is simple: raise taxes.

Included in Biden’s proposed tax plans — erroneously named the American Families Plan — are hikes in personal income tax and capital gains tax rates. The plan would raise the top marginal income tax rate from 37 percent to 39.6 percent and reclassify long-term capital gains and qualified dividends as ordinary income for those with taxable income above $1 million, resulting in a top marginal tax rate of 43.4 percent, according to the Tax Foundation.

Despite the frustration (or excitement) that Americans have towards Biden’s income and wealth tax proposals in the midst of an economic recovery, Americans should be paying closer attention to his other proposals, the American Jobs Plan and the Made in America Tax Plan.

Read MoreCommentary: The Treacherous Road to Runaway Inflation

In January, 2001, America had a balanced budget, low debt, and was at peace. Here, briefly, is what lay ahead: war, financial crisis, civil unrest, massive growth of the federal government, and now severe inflation.

Never in the history of America has our government in its ineptitude created such a false economy, risking hundreds of years of hard work on unsound and unworkable economic policies. The Founders wisely relied on dispersion of power. They knew there would be dishonest and incompetent politicians but, in this case, the entire government is infected with deceptive leaders.

Read MoreCommentary: The Biden Inflation Tax, Made Clear in One Chart

What is all this “Biden inflation tax” talk really about? What is the actual effect of inflation on the lives of real people?

Well, below is a chart that compares yearly wage and inflation rates for each month from 2017 through July of this year using Bureau of Labor Statistics data. Wage rates are in blue and inflation (as measured by the consumer price index) is in red. When blue is on top, as it was during the entire Trump administration, workers’ wages are beating inflation and their standards of living are improving. When red is on top, they’re not.

While President Biden claims that it is “indisputable” that his jobs plan “is working,” this chart unequivocally shows that it is not, at least not for American workers. Rather, inflation is surging, more than wiping out any wage gains those workers might have experienced.

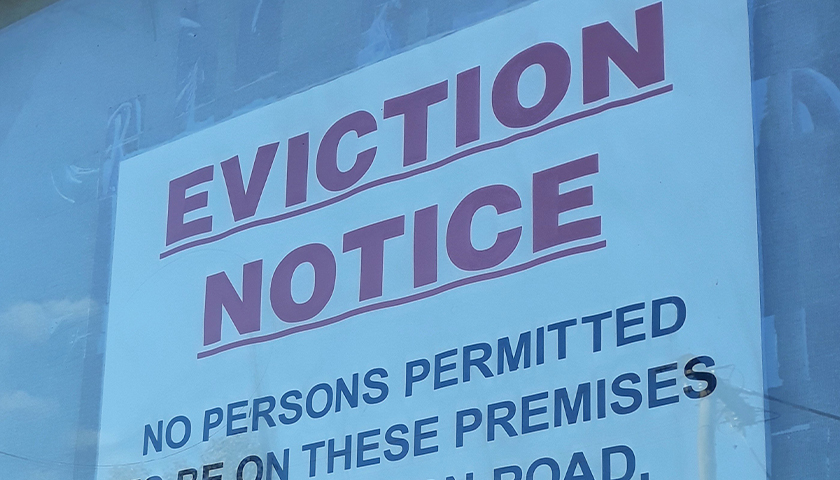

Read MoreFederal Court Sides with Biden’s Eviction Moratorium, for Now

A federal judge in Washington, D.C., ruled Friday against a challenge to President Joe Biden’s latest eviction moratorium.

U.S. District Judge Dabney Friedrich denied a request from the Alabama and Georgia association of Realtors to overturn an eviction moratorium from the U.S. Centers for Disease Control and Prevention. The 60-day order bans landlords from evicting tenants, even if they do not pay rent, citing concerns over the spread of COVID-19.

“About half of all housing providers are mom-and-pop operators, and without rental income, they cannot pay their own bills or maintain their properties,” National Association of Realtors President Charlie Oppler said. “NAR has always advocated the best solution for all parties was rental assistance paid directly to housing providers to cover the rent and utilities of any vulnerable tenants during the pandemic. No housing provider wants to evict a tenant and considers it only as a last resort.”

Read MoreCommentary: Don’t Be Fooled by the Bipartisan, ‘Paid For’ Infrastructure Bill

Over the course of the pandemic, federal overspending has exploded even by Congress’s lofty standards. While trillion-dollar deficits were a cause for concern before 2020, spending over just the last two years is set to increase the national debt by over $6 trillion. It’s bizarre, then, that the only thing that members of opposing parties in Congress can seem to work together on is fooling the budgetary scorekeepers with phantom offsets for even more spending.

In total, the bipartisan infrastructure deal includes around $550 billion in new federal spending on infrastructure to take place over five years. Advocates of the legislation claim that it is paid for, but they are relying on gimmicks and quirks of the budget scoring process to make that claim.

Take the single biggest offset claimed — repurposing unused COVID relief funds, which the bill’s authors say would “raise” $210 billion (particularly considering that at least $160 billion have already been accounted for in the Congressional Budget Office (CBO) baseline). Only in the minds of Washington legislators does this represent funds ready to be used when the national debt stands at over $28 trillion.

Read MoreSenate Fails to Wrap Up Infrastructure Bill After Talks to Expedite Process Collapse

Senate Majority Leader Chuck Schumer set up a critical vote on the bipartisan infrastructure bill Saturday after talks to expedite the process fell apart late Thursday.

Both Republicans and Democrats engaged in marathon talks Thursday in a bid to vote on a package of amendments and to advance the sweeping public works package. Doing so, however, required approval from all 100 senators, and Tennessee Republican Sen. Bill Haggerty refused to go along even as his Republican colleagues urged him to do so.

In a statement, Hagerty attributed his objection to the Congressional Budget Office’s estimation that the bill would add $256 billion to the national debt over 10 years.

Read MoreNewt Gingrich Commentary: The Higher Inflation and Bigger Debt Act

The $3.5 trillion spending bill set up to follow the $1.1 trillion infrastructure bill (which has little to do with infrastructure) should be called what it really is: The Higher Inflation and Bigger Debt Act.

The Democrats would like you to believe it is only a reconciliation bill. This is vital to them because a reconciliation bill only takes 50 senators and the vice president to pass the U.S. Senate.

However, this additional $3.5 trillion comes after trillions of emergency spending prompted by the COVID-19 pandemic. Consider what the Congressional Budget Office has written about the fiscal situation before the $1.1 trillion and $3.5 trillion bills are passed:

Here is what the Congressional Budget Office forecasts (not counting Biden’s enormous spending plan):

“By the end of 2021, federal debt held by the public is projected to equal 102 percent of GDP. Debt would reach 107 percent of GDP (surpassing its historical high) in 2031 and would almost double to 202 percent of GDP by 2051. Debt that is high and rising as a percentage of GDP boosts federal and private borrowing costs, slows the growth of economic output, and increases interest payments abroad. A growing debt burden could increase the risk of a fiscal crisis and higher inflation as well as undermine confidence in the U.S. dollar, making it more costly to finance public and private activity in international markets.”

Read MoreU.S. Set to Hit Debt Ceiling Within Four Months, Congressional Budget Office Estimates

The federal government is on track to reach the statutory debt limit in the fall, which would trigger a government shutdown, according to a Congressional Budget Office (CBO) estimate.

The U.S. is projected to reach the debt ceiling of $28.5 trillion by October or November, a CBO report released Wednesday stated. If Capitol Hill lawmakers don’t reach an agreement on raising the limit higher, the government could undergo its third shutdown in less than four years.

“If the debt limit remained unchanged, the ability to borrow using those measures would ultimately be exhausted, and the Treasury would probably run out of cash sometime in the first quarter of the next fiscal year (which begins on October 1, 2021), most likely in October or November,” the CBO report said.

Read MoreOver 100 Countries Agree to Back Global Minimum Corporate Tax

A total of 130 nations representing more than 90 percent of global GDP have agreed to a global minimum corporate tax, Treasury Secretary Janet Yellen announced Thursday.

The tax, proposed by Yellen and the Biden administration during the G7 conference, would establish a minimum corporate tax rate across all participating countries to prevent corporations from avoiding taxes by incorporating offshore, according to Barron’s. The plan is also intended to prevent countries from competitively lowering their tax rates to attract investment, according to a Treasury Department statement.

“For decades, the United States has participated in a self-defeating international tax competition, lowering our corporate tax rates only to watch other nations lower theirs in response,” Yellen said in the statement.

Read MoreCommentary: It is Time to Fight for the Rights of Independent Businesses

As a very young man, I was fortunate enough to start my own company out of my apartment using a small amount of investment capital from friends and family. Over time, that business grew to have over 6,000 employees and revenues in excess of $2 billion. Over nearly a 40-year span, my team and I built what some would consider a remarkable track record, as measured by both sales and profits.

Because of my experience growing that business, I feel a special kinship with small, privately owned businesses and their owners. I also come from a middle-class background, one that shaped me into the person I am today. It is through both the lens of entrepreneur and member of the middle-class that I look through when reflecting upon this Independence Day.

Read MoreCommentary: Making Sense of the Post-Pandemic Economy

Are you having a hard time understanding why the housing market is heating up, and why the cost of essentials such as milk, eggs, and gas is climbing? Are you in the market for a used car? Then you know how expensive those are right now. And why can’t businesses find employees, yet millions remain unemployed? Economists agree the recovery isn’t like anything we’ve seen before. That’s because we’ve never had a situation before where the heavy hand of government shut down private enterprises on a nationwide scale. The market distortions are enormous. As states reopen, there is a herky-jerky feel to the economy that has many people unsettled.

Former Federal Reserve vice chairman Alan Blinder wrote in the Wall Street Journal recently, “the recovery is not linear. Rather, it is proceeding in fits and starts. Sales of physical goods, for example, dipped only briefly when Covid hit, recovered quickly, and are now well above their pre-pandemic levels. In stark contrast, businesses that deliver personal services, such as restaurants and hotels, suffered a devastating depression and are still below their pre-pandemic levels.”

By far the most uneven outcome so far since the economy crashed in spring 2000, besides the 7.6 million fewer jobs compared to pre-pandemic levels, has been inflation, which is up 5 percent the past 12 months.

Read More