The Biden administration has finally published its anticipated ultimatum threatening companies like mine with severe fines and penalties for not firing any employee who declines to be vaccinated against or submit to invasive weekly testing for COVID-19. The new rule promulgated by the U.S. Labor Department’s Occupational Safety and Health Administration (OSHA) under the guise of workplace safety may well bankrupt the business my father founded. So, as the CEO of the Phillips Manufacturing & Tower Company, I am joining with The Buckeye Institute to challenge OSHA’s vaccine mandate in court. Here’s why.

Phillips is a 54-year-old company based in Shelby, Ohio, that manufactures specialty welded steel tubing for automotive, appliance, and construction industries. OSHA’s emergency rule applies to companies with 100 or more employees — at our Shelby Welded Tube facility, we employ 104 people. As a family-owned business I take the health of my workers seriously — they are my neighbors and my friends. When I heard of the mandate, we conducted a survey of our workers to see what the impacts would be. It revealed that 28 Phillips employees are fully vaccinated, while antibody testing conducted at company expense found that another 16 employees have tested positive for COVID-19 antibodies and likely possess natural immunity. At least 47 employees have indicated that they have not and will not be vaccinated. Seventeen of those 47 unvaccinated workers said that they would quit or be fired before complying with the vaccine or testing mandate. Those are 17 skilled workers that Phillips cannot afford to lose.

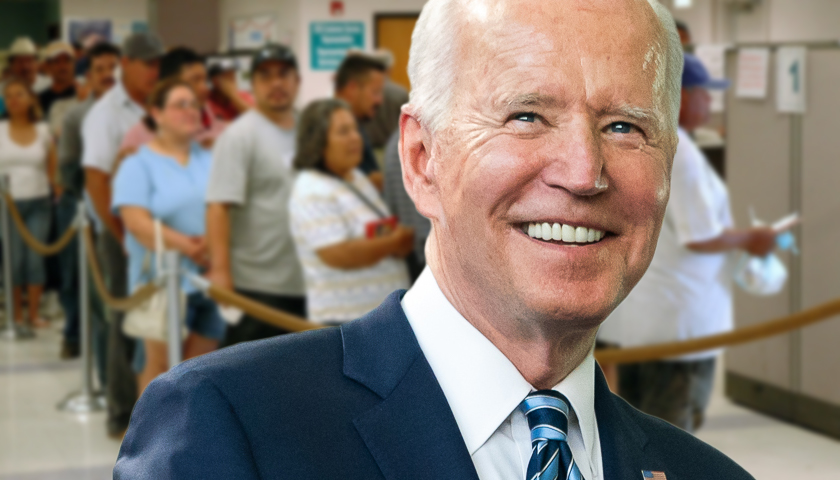

Perhaps the Biden administration remains unaware of the labor shortage currently plaguing the U.S. labor market generally and industrial manufacturing especially. Like many companies, Phillips is already understaffed, with seven job openings we have been unable to fill. Employees already work overtime to keep pace with customer demand, working 10-hour shifts, six days a week on average. Firing 17 veteran members of the Phillips team certainly won’t help.

Read More