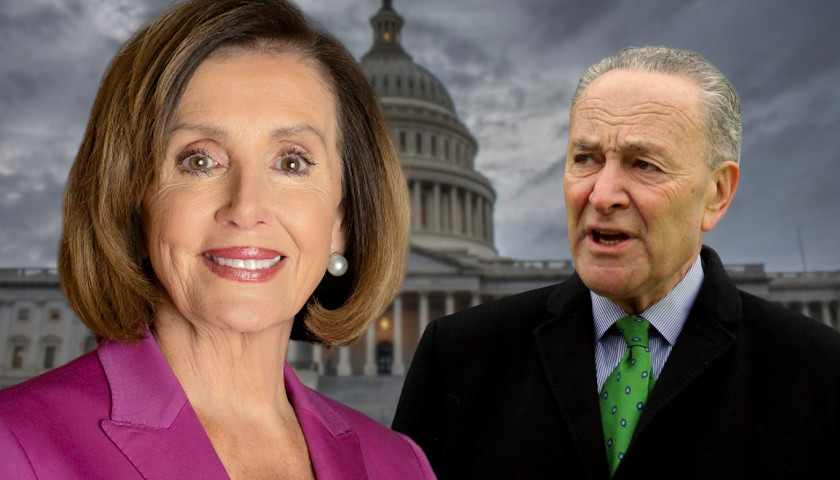

Americans have come together in the fight against the invisible enemy, but this situation has been made worse by some politicians who seek to take advantage of this pandemic and our recovery while so many are suffering. President Trump has been working around the clock to slow the spread of the Wuhan virus and get the economy going again, but Nancy Pelosi and Chuck Schumer have used this crisis to push their radical socialist agenda and grow the size of government. Twice now, Nancy Pelosi held American families, workers, and businesses hostage for days by delaying relief funding in the name of securing tens of millions of dollars for the Kennedy Center, pushing her Green New Deal, changing voting laws, and growing government to advance her radical socialist agenda.

Even more recently, there have been calls to give handouts to failing state and local governments, not because of the coronavirus, but because these states have been mismanaged and run irresponsibly. The American taxpayer should not bail out state and local governments for the reckless fiscal decisions made before the coronavirus.

Read More