A great plague of our contemporary political landscape is that one bad policy begets even more bad policies. Such is the case with many of America’s existing immigration laws.

Federal law, for example, calls for specific enforcement protocols. But our elected representatives have decided that some of those protocols simply should be ignored. This mindset led to ideas like catching and then releasing illegal aliens into our communities, preventing local law enforcement from working with federal law enforcement, and “sanctuary” cities where those who have broken our laws can hide from accountability.

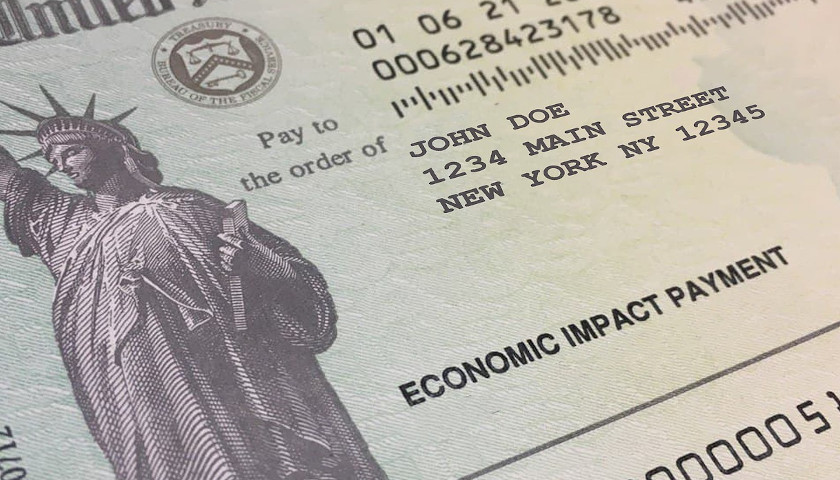

From this witches’ brew of bad ideas has come the latest product rollout, one suited for our time: stimulus checks for illegal aliens. Using the economic damage caused by COVID-19 as a pretext, anti-borders activists and their allied politicians have found a way to sustain those here illegally while creating further incentives for even more foreign nationals to move here.

Read More