The unemployment rate in the U.S. ticked upwards to 4.2 percent in November, with 161,000 additional Americans saying they are unemployed in the latest household survey by the Bureau of Labor Statistics.

Read MoreTag: tax cuts

Trump Pledges to Eliminate Taxes on Overtime

Former President Donald Trump on Thursday pledged to eliminate taxes on overtime wages if he is elected back to the White House in November.

Read MoreCommentary: President Trump’s Policy Victories, from A to Z

Whatever one thinks about President Donald J. Trump’s personality, his policies were the most conservative reforms that America has seen since President Ronald Wilson Reagan left office — and perhaps even before he arrived.

Read MoreMinnesotans Demand Permanent Tax Cuts: ‘They’re Stealing from Us’

Minnesotans are calling on Gov. Tim Walz and the Legislature to return the record-breaking $9.3 billion budget surplus to the people by permanently cutting taxes.

A crowd gathered inside the Minnesota Capitol rotunda Saturday for the “Give it Back Tax Rally.” The rally was hosted by the Center of the American Experiment and involved several speakers including multiple radio hosts and a former U.S. congressman.

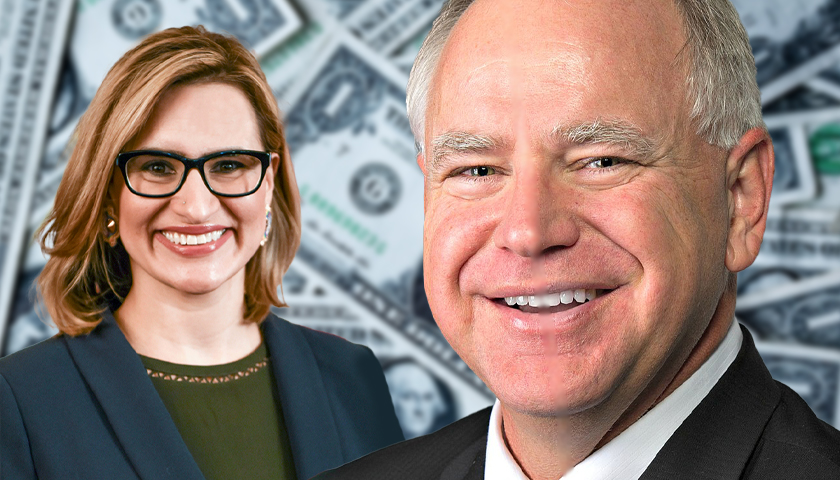

Read MoreGovernor Walz Releases Proposed Budget, Includes $500 Payments to Residents

Minnesota Governor Tim Walz and Lieutenant Governor Peggy Flanagan released a new budget that considers a budget forecast projecting an increased surplus.

An analysis from the Minnesota Management and Budget office detailed that the state’s budget surplus has increased to roughly $9.3 billion.

Read MoreMinnesota Ranks Among States with Highest Income Tax, New Report Shows

Minnesota ranks among states with the highest income tax, a new report from the Tax Foundation shows.

The organization, a nonpartisan nonprofit that analyzes tax policies from each state, ranked the governments based on the impact of their individual income taxes, as Minnesota was placed at number 43 in the country.

Read MoreConnecticut Gov. Lamont Proposes $336 Million in Tax Cuts

Gov. Ned Lamont said he is proposing a package of legislative proposals that would provide for $336 million in tax relief for state residents.

The governor announced the first package of tax aid comes as the state has a projected $1.48 billion surplus in its operating budget. The surplus, Lamont said, enables the tax cuts to be built into the budget and will ensure the state’s Rainy Day Fund remains strong.

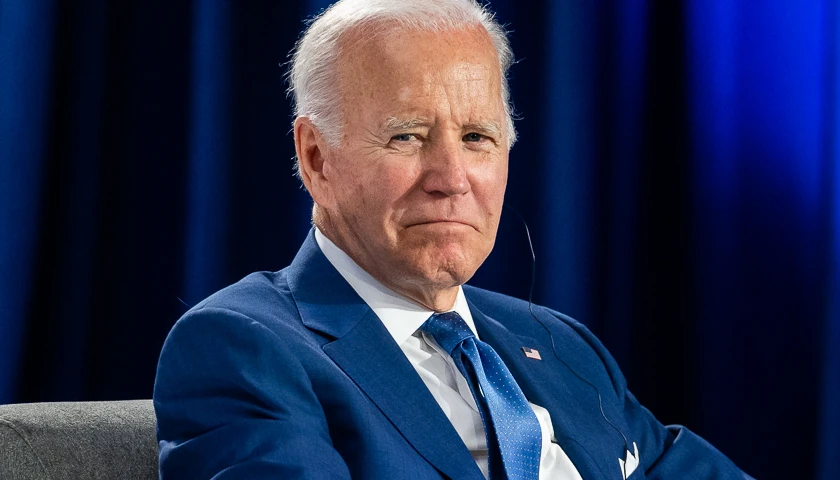

Read MoreTrump Ended His First Year With Big Tax Cut Win, Biden Finishes His With Crushing Manchin Loss

Buffeted by a Russia scandal that proved false, Donald Trump ended the first year of his presidency on a high note with passage of historic tax cuts. In contrast four years later, Joe Biden’s first year in office is ending with a stunning rebuke from a senator in his own party.

On Sunday, Sen. Joe Manchin (D-W.Va.) gave a resounding “No” to Biden’s signature Build Back Better legislation, leaving an uncertain path for the Democrats’ ambitious agenda despite the fact they control the Senate, House and White House.

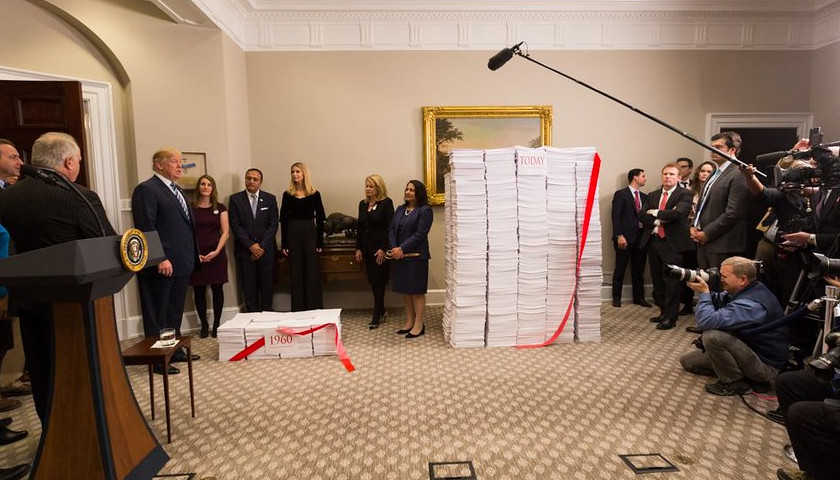

Read MoreStudies: Trump Tax Cuts Helped Lower Income Families, Build Back Better Helps Wealthier Americans

Democrats have argued that the tax reforms implemented through the 2017 Tax Cuts and Jobs Act (TCJA) only benefited the rich, and that the Build Back Better Act (BBBA) will help middle-and working-class Americans the most.

But several nonpartisan groups found that the TCJA reduced the tax burden for the middle- and working-class by up to 87% and, they argue, the $2.4 trillion BBBA – before the U.S. Senate this week – would increase taxes on the middle- and working-class by up to 40%.

A new analysis published by the Heartland Institute found that the TCJA reduced the average effective income tax rates for taxpayers in every income tax bracket – but the lower- and middle-class saw the greatest benefits – with the lowest-income filers receiving the largest tax cuts.

Read MoreAnalysis: Federal Tax Overhaul Increased Taxes on Wealthy in Many Blue States

The 2017 Tax Cuts and Jobs Act, harpooned by progressive Democrats as a handout to wealthy corporations, turned out to be more progressive in practice, new data from the federal government revealed.

The federal tax reform measure supported by President Donald Trump increased taxes on some wealthy property owners in high-tax jurisdictions such as Illinois and New Jersey and decreased tax burdens on the middle class.

Read MoreSecond Wave of Middle Class Tax Cuts Slated for September

Keeping with his promise in 2018 that he would be issuing a second round of tax cuts, President Donald Trump’s administration signaled that details of the new cuts would be announced in September.

Read MoreCommentary: Embrace Fiscal Responsibility, Not Tax Cuts, in 2020

As Democratic presidential candidates stumble over one another in a headlong rush towards socialism and fiscal insanity—promising trillions in new spending on everything from child care, health care, and higher education for all, to “the Green New Deal” and slavery reparations—President Trump faces a critical choice.

Read MoreCommentary: The Truth About How Much Americans Are Paying in Taxes

by Adam Michel As Americans file their taxes this April, they might be in for a surprise: Most Americans got a tax cut last year. It shouldn’t be a surprise given the Tax Cuts and Jobs Act of 2017, but unfortunately, the media have produced a never–ending deluge of…

Read MoreTrump Tax Cuts Spur Unexpectedly High State Revenues

by Evie Fordham The Tax Cuts and Jobs Act touted by President Donald Trump is one of three reasons that at least 19 states are reporting unexpectedly high general fund revenue halfway through fiscal year 2019, tax policy expert Adam Michel told The Daily Caller News Foundation Thursday. “Trump…

Read MoreIn FY2018, the Deficit Increased – But Not Because of Tax Cuts

by Robert Romano The numbers for the end of Fiscal Year 2018 are in and they aren’t pretty for fiscal hawks, as the budget deficit increased by an eye-popping $113 billion to $779 billion. But it had nothing to do with tax cuts. Tax receipts rose by $14 billion.…

Read MoreTrump Tax Cuts At Risk: Democrats Conspire to Repeal While Record Low Unemployment Surges

Tennessee Star Political Editor Steve Gill discussed on Monday’s edition of The Gill Report – broadcast on Knoxville’s 92.3 FM WETR – how Democrats are conspiring to repeal the Trump tax cuts while record low unemployment among Hispanic and African-Americans surge and the federal government rakes in a record amount of…

Read MoreHardly ‘Crumbs’: Cookie Maker Hires Five Workers, Raises Pay, Expands Production Under Tax Cuts

by Rachel del Guidice The overhaul of the tax code by congressional Republicans didn’t produce just crumbs for the business of a popular cookie maker based in Florida. The Tax Cuts and Jobs Act has meant hiring, raises, investment in new equipment, and expanded operations, he says. “It has had…

Read More