Former IRS contractor Charles Littlejohn was sentenced to five years in prison on Monday after leaking former President Donald Trump’s tax records, according to NBC News.

Read MoreTag: Tax Returns

Commentary: Release Pelosi’s Tax Returns

Court Rules Congress Can Obtain Trump’s Tax Returns One Day After Mar-a-Lago Raid

One day after FBI agents raided Donald Trump’s Mar-a-Lago estate, the D.C. Court of Appeals ruled on Tuesday that the Internal Revenue Service must hand over the former president’s tax returns to the House Ways and Means Committee.

Read MoreCommentary: Be Very Skeptical About Sen. Warren Throwing More Money at the IRS

Closing the “tax gap,” or revenue owed to the federal government that goes uncollected, has long been a favorite deus ex machina for lawmakers who want more revenue without having to raise rates. But Internal Revenue Service (IRS) Commissioner Chuck Rettig really put dollar signs in lawmakers’ eyes when he claimed the tax gap could be as large as $1 trillion. Always eager to appear knowledgeable on policy issues, Sen. Elizabeth Warren is putting forward a plan to collect extra revenue that only gets worse the deeper you dig into it.

First and foremost, it’s important to understand how far off on an island Rettig is with his estimate. The IRS’s last official estimate of the size of the tax gap placed it at a far, far lower $381 billion. Even considering that this estimate may not have factored in underpayment from cryptocurrencies, offshore holdings, and pass-through businesses, the tax gap still remains far closer to $500 billion than to $1 trillion.

Read MoreTax, Legal Experts Agree Leaker of Trump’s Tax Returns Could Face Prison Time

Tax and legal experts say the leaker or leakers who took President Trump’s personal tax returns and gave them to The New York Times, committed a felony punishable by prison.

Joseph diGenova, a former U.S. Attorney for the District of Columbia who has advised Trump on some legal matters, told Just the News that the leaking was “definitely” a crime that could be liable for both criminal and civil legal actions.

Read MoreThe New York Times Claims It Has Obtained President Trump’s Tax Returns, Trump Organization Attorney Says ‘The Facts Appear to be Inaccurate’

The New York Times published a lengthy report over the weekend based, they say, documents they obtained from “sources.”

Speaking at a news conference Sunday at the White House, Trump dismissed the report as “fake news” and said he has paid taxes, though he gave no specifics. He also vowed that information about his taxes “will all be revealed,” but he offered no timeline for the disclosure.

Read MoreFederal Judge Blocks California’s Trump Tax Return Law

On Thursday, a federal judge blocked the state of California from enforcing a newly-passed law that was directly targeting President Donald Trump over his tax returns, as reported by Reuters.

Read MoreStar Tribune Moves April Story on Omar’s ‘Strong’ Fundraising Efforts to Front Page Amid Campaign Finance Scandal

The Star Tribune promoted a months-old story on Rep. Ilhan Omar’s (D-MN-05) “strong” fundraising numbers on the front page of its website Friday. The article was linked directly below a story on the Minnesota Campaign Finance and Public Disclosure Board’s investigation into Omar. The Board, which released its report…

Read MoreNew York Lawmakers Pass Bill That Would Allow Congress Access to Trump’s Tax Returns in the State

by Neetu Chandak The New York state Assembly passed a bill Wednesday to allow Congress to obtain information on state tax returns for elected officials, which would include President Donald Trump’s returns. The bill passed 84-53 and would allow the New York Department of Taxation and Finance commissioner to…

Read MoreTrumps Sue Banks to Keep Them from Complying with Congressional Subpoenas

by Chuck Ross President Donald Trump, his three oldest children, and their companies sued Monday to prevent their two banks from complying with congressional subpoenas for personal and business financial records. The Trump lawyers argued in the lawsuit that the subpoenas, which were issued to Deutsche Bank and Capital…

Read MoreCommentary: Check Your Tax Return Again, You Probably Paid Less This Year Under the Trump Tax Cuts

by Robert Romano Only 40 percent of respondents in a recent New York Times-SurveyMonkey online poll thought they had received tax cuts under the 2017 tax cut legislation that was signed into law by President Donald Trump. A separate NBC-Wall Street Journal poll found 28 percent believe they will…

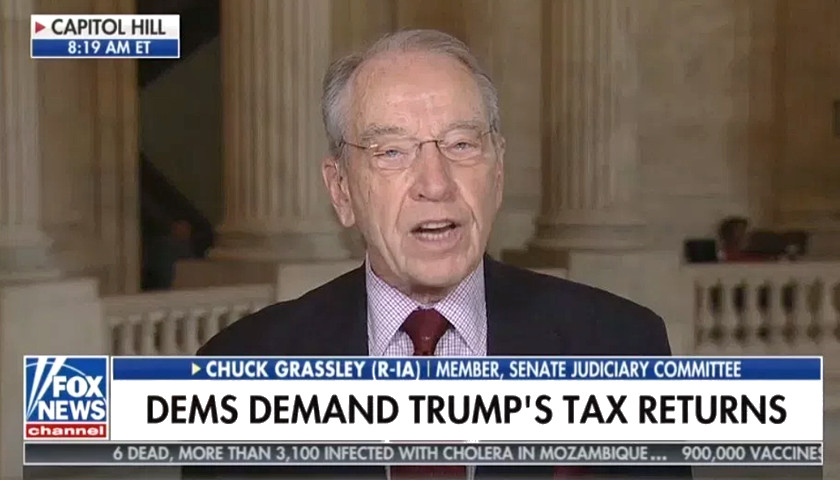

Read MoreGrassley Explains Why He Doesn’t Want To See Trump’s Tax Returns

by Nick Givas Sen. Chuck Grassley explained why he wasn’t interested in seeing President Donald Trump’s personal tax returns, on “Fox & Friends” Monday. “Listen, you’re asking me as chairman of the Finance Committee, we would have an opportunity to see [Trump’s tax returns] too. I don’t want to…

Read MoreMick Mulvaney: Democrats Will ‘Never’ See President Trump’s Tax Returns

by Henry Rogers Acting White House Chief of Staff Mick Mulvaney said Democrats in Congress will “never” succeed in obtaining President Donald Trump’s tax returns. Mulvaney mentioned in an interview with “Fox News Sunday” how Democrats are demanding the IRS to hand over Trump’s tax returns. “Democrats are demanding that the…

Read MoreSen. Amy Klobuchar Latest 2020 Hopeful to Release Taxes

Democratic presidential candidate Amy Klobuchar released 12 years of tax returns Monday, saying “transparency and accountability are fundamental to good governance.” The Minnesota senator was the latest 2020 contender to make her returns public. The tax returns date back to 2006, when she first became a candidate for federal office.…

Read More