The average American’s energy bill could increase from 25% to 70% in the next 10 years without intervention from policymakers, according to a new study from Washington, D.C.-based think tank the Jack Kemp Foundation.

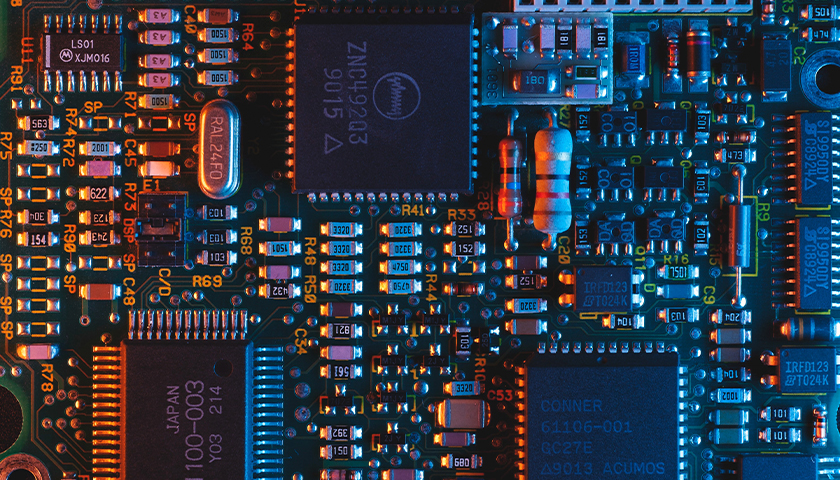

According to reports, America is facing an energy crisis, with demand for energy soaring due to the proliferation of AI and hyperscale data centers, which can use as much energy as almost 40,000 homes; the boom in advanced manufacturing, and the movement toward electrification.

Read More