The unemployment rate in the U.S. ticked upwards to 4.2 percent in November, with 161,000 additional Americans saying they are unemployed in the latest household survey by the Bureau of Labor Statistics.

Read MoreTag: Recession

Analysis: RCM/TIPP Economic Index Slumps Again

The RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment, dropped sharply 3.1 percent in June to 40.5. Since September 2021, the index has remained in negative territory for 34 consecutive months. June’s reading of 40.5 is 17.6 percent lower than the historic average of 49.2.

Optimism among investors edged up 0.4 percent from 46.3 in May to 46.5 in June, while it slumped by 6.0 percent among non-investors, from 40.1 in May to 37.7 in June.

Read MoreCommentary: As Consumer and Producer Inflation Cools, Recession Maybe on the Horizon in 2024

Both annualized consumer and producer inflation decreased in October from 3.7 percent to 3.2 percent and from 2.2 percent to 1.3 percent, respectively, according to the latest data from the Bureau of Labor Statistics, amid a drops in oil prices.

On the consumer side, gasoline prices dropped 5 percent in October and are down 5.3 percent over the past twelve months.

Read MoreCommentary: Recession May Be Coming After 514,000 More Americans Struggle to Find Employment

The national unemployment rate reported by the Bureau of Labor Statistics jumped from 3.5 percent to 3.8 percent in August as an additional 514,000 Americans said they could not find work in the Bureau’s household survey. Now 6.3 million Americans are said to be unemployed, the highest in more than a year.

But it did not come with a commensurate drop in the number of Americans saying they were working, which also increased by 222,000 to 161.48 million.

Read MoreConsumer Confidence Hits Near-Recession Low

The latest index of U.S. consumer confidence fell to a new low in the month of August, hitting levels that would normally indicate a coming recession.

As Breitbart reports, the Conference Board confirmed on Tuesday that the index fell to 106.1 in August, down from 114 in July. Economists had originally projected that it would rise to 116.6, and had predicted that July would reach 117.0.

Read MoreCommentary: Recession Looms as Banks Collapse and the Economy Slows

The unemployment rate still remains at historic lows of 3.4 percent in April, according to the latest data by the Bureau of Labor Statistics, amid other worrying signs for the U.S. economy including a continued collapse of job openings, a string of bank failure and an overall slowing Gross Domestic Product (GDP).

In the survey, as the population increased by 171,000, those not in the labor force increased by 214,000 as labor participation dipped slightly by 43,000. Those who said they had a job increased by 139,000 after a 577,000 increase in March. As a result, the unemployment rate has actually ticked downward for two consecutive months from 3.6 percent in February, to 3.5 percent in March and now 3.4 percent in April.

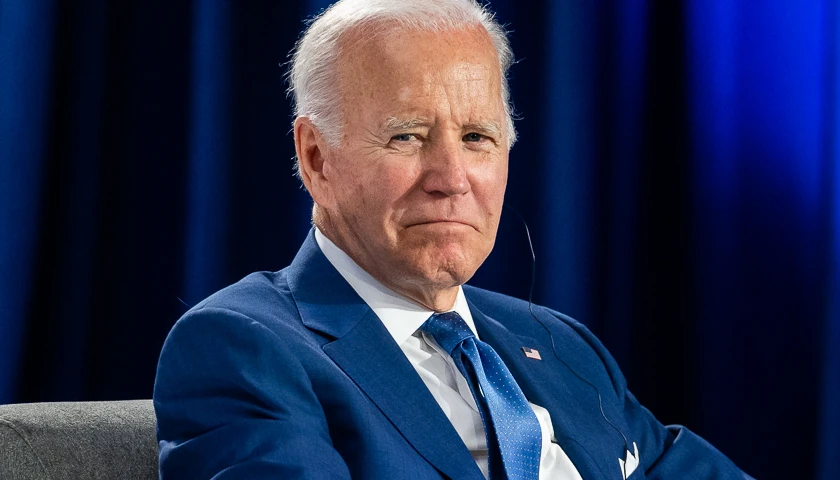

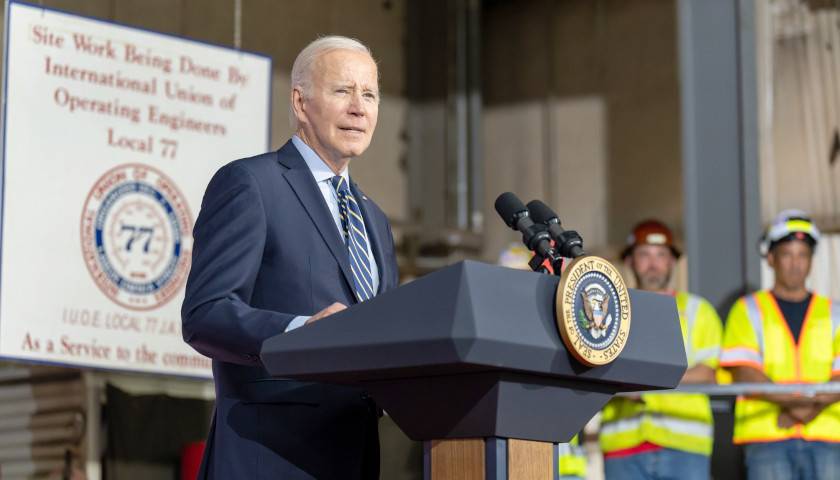

Read MoreCommentary: On Economy, Biden Re-Election Faces Challenges

As President Biden embarks on his reelection campaign, a majority of American voters are dissatisfied with his stewardship of the U.S. economy. Aware of the general angst among the electorate, Biden is threading the needle by saying he’s running on the strength of his overall record, while vowing to “finish the job” that he started when he stepped into the Oval Office. It’s a daunting task, with an overwhelming majority of registered voters expressing deep pessimism about the economy: 40.2% say the United States is currently in a recession, 17% call it a general state of stagnation, and 10.4% believe the country is in an outright depression.

Read MoreUnemployment Claims Rise in Minnesota

Minnesota had the sixth lowest decrease in unemployment claims since last week, WalletHub reported Thursday.

Across the country, new unemployment claims decreased 7.3% week-over-week March 27 amid high inflation and threat of a recession, the report said.

Read MoreDecember Consumer Spending Declines; Recession Concerns Remain

Consumer spending fell 0.2% in December from the previous month, the Commerce Department said Friday.

Read MoreU.S. GDP Ticks Up, but Recession Fears Remain

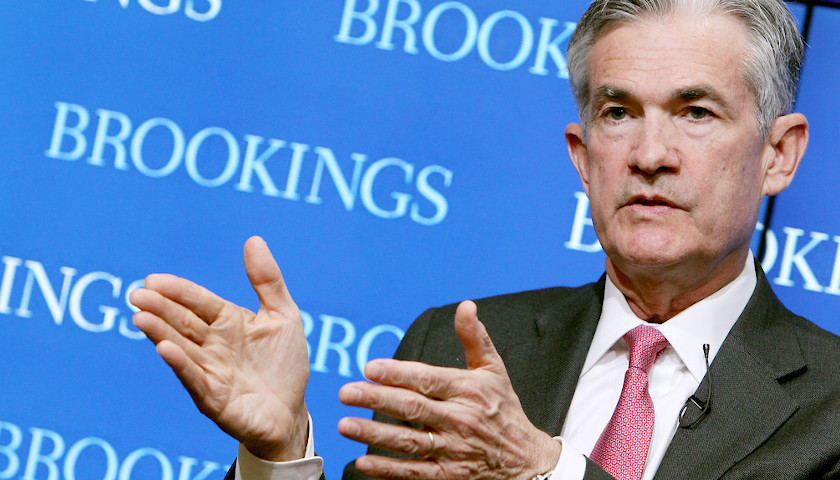

The U.S. economy grew modestly in the fourth quarter of 2022, despite signs of weak domestic demand, according to the Bureau of Economic Analysis (BEA) Thursday. In the fourth quarter, inflation-adjusted gross domestic product (GDP) grew by roughly 2.9%, down slightly from 3.2% in the third quarter, the BEA reported. Recession concerns among economists linger, however, amid fears that the Federal Reserve’s campaign of interest rate hikes — intended to reduce economic demand to slow inflation — will lead to reduced spending and layoffs, The Wall Street Journal reported.

Read MoreBig Banks Predict Significant Economic Downturn in 2023: POLL

Of the 23 major financial institutions that work directly with the Federal Reserve, 16 anticipate a recession within the next 12 months, with two anticipating one the year after, according to a survey published by The Wall Street Journal Monday.

These institutions, which range from Bank of America to UBS, note that Americans are spending their savings, banks are heightening lending standards and the housing market is in a decline, all classic warning signs that a recession is impending, the WSJ reported. All of this is being exacerbated, the banks say, by the Fed’s historically aggressive pace of interest rate hikes, designed to blunt stubbornly persistent inflation.

Read MoreSpecial Report: Latino Youth Vote Comes into Focus after Democrats Sweep Gen Z

by Gelet Martínez Fragela As Republicans continue to grapple with a devastating loss among young adults from the 2022 midterm elections, some statistics suggest the GOP has an opportunity to pick up some traction with the Latino youth vote as their concerns could grow with age about crime, inflation…

Read MoreJPMorgan Strategists Predict Stock Plunge, Recession as Early as First Half of 2023

Strategists at JPMorgan Chase predicted a recession as soon as the first half of 2023, coupled with a major stock market slide, in a research note Thursday, according to Bloomberg.

The strategists expected the S&P 500 stock index to decline roughly 12% in the first half of next year, before rebounding to end 2023 up 3% as inflation cools and the Federal Reserve slows or reverses its aggressive campaign of interest rate hikes, Bloomberg reported. Despite the expectation that the stock market will rebound by the end of next year, the analysts anticipated that U.S. corporate earnings would fall roughly 9% as demand slumps and economic conditions limit companies’ ability to set higher prices.

Read MoreGoldman Sachs Issues Stock Market Warning

U.S. investors are significantly underestimating the risk of a recession, potentially increasing the impact of a recession next year, economists at Goldman Sachs warned in a Monday research note, according to Bloomberg.

Researchers at Goldman estimate a 39 percent chance of a slowdown in U.S. growth, but risk assets only account for an 11 percent chance, Bloomberg reported. By underestimating the chance of a recession, investors are increasing their exposure to the effects of “recession scares” in 2023, the analysts warned.

Read MorePoll: Small Business Owners Trust Republicans to Help Them Amid Recession Fears

Small business owners believe they’ll benefit from Republican victories in the upcoming elections, according to a new poll.

Most small business employers believe the country is in a recession, and fear that economic conditions will put them out of business, with a majority believing a Republican victory will help them, according to the survey conducted by Rasmussen and the Job Creators Network Foundation (JCNF). The poll reflects a broader concern among voters about economic conditions and historic levels of inflation under the Biden administration.

Read MoreInvestors Show Concern over Defaulting Mortgages as Possible Recession Looms

Investors are reportedly concerned about mortgage defaults and are unloading Fannie Mae and Freddie Mac securities, amid record-high interest rates and a rapidly cooling housing market.

Mortgage rates last week hit a two-decade high of 6.92%, a trend that has slowed the booming, often over-priced real estate market during the height of the pandemic.

Read MoreExpect Layoffs and a Recession If Fed Doesn’t Let Up, Bank of America Exec Warns

If the U.S. Federal Reserve continues its policy of aggressive interest rate hikes, the U.S. could lose hundreds of thousands of jobs, spiking unemployment, according to a Bank of America analysis, CNN reported.

Bank of America’s Chief U.S. Economist Michael Gapen expects roughly six months of relatively high unemployment and a”mild recession,” as the Fed’s aggressive interest rate hikes blunt consumer demand, he told CNN Monday. However, Gapen also noted that the typical bounceback seen after a recession might be delayed if the Fed, which has been incredibly hawkish on interest rates, refuses to reduce rates.

Read MoreCommentary: Federal Reserve’s False Assumptions Push the Economy into Recession

Based on its assumptions, the Federal Reserve is doing everything right by raising interest rates rapidly after years of easy money. It will certainly succeed in its goal of “cooling down” the economy.

Unfortunately, the Fed’s basic assumptions are wrong, and it has already begun reducing Americans’ standard of living, as indicated by this week’s Commerce Department report showing the nation’s gross domestic product fell for the second quarter in a row, meeting the common definition of a recession.

Read MoreBiden Has 38 Percent Approval in New Poll; 61 Percent of Likely Voters Say We’re in a Recession

Joe Biden’s approval rating is holding steady at 38 percent in the latest poll conducted by Insider Advantage for the Center for American Greatness. The national survey of 800 likely voters showed that 60 percent of respondents disapproved of Biden’s job performance, and 5 percent had no opinion or were undecided.

Read MoreCommentary: Amid Recession Fears, Economically Free States Continue to Outperform

Florida Gov. Ron DeSantis recently responded to questions about California Gov. Gavin Newsom’s ads airing in Florida, “It’s almost hard to drive people out of a place like California given all their natural advantages, and yet they are finding a way to do it.” He noted that California is hemorrhaging its population because of bad progressive economic policies so that they could be more free

Florida ranks third in the nation for economic freedom, according to the Fraser Institute. And California ranks second to last.

Read More‘It’s An Absurd Argument’: Economists Take Apart One of Biden’s Favorite Talking Points

The Biden administration’s oft-touted talking point that employment has boomed under the administration is misleading and instead simply a natural recovery from pandemic losses, economists told the Daily Caller News Foundation.

Facing consecutive quarters of negative gross domestic product (GDP) growth, sky-high inflation and plummeting consumer sentiment, the Biden administration has routinely cited a low unemployment rate and strong on-paper jobs creation as positive results of President Joe Biden’s economic stewardship. But the notion that these figures represent booming job creation is misleading since the economy has merely rebounded by adding back jobs that were lost during the pandemic and has still yet to reach pre-pandemic levels, economists told the DCNF.

Read MoreCommentary: Biden Opts to Redefine ‘Recession’ Rather than Beat It

TWIL: What everybody thought constituted a recession no longer does.

The Bureau of Economic Analysis announced that gross domestic product (GDP) fell by 0.9 percent in the second quarter. This follows a 1.6 percent contraction in the first quarter.

Read MoreThe Fed’s Preferred Inflation Metric Just Surged in Another Warning Sign for the Economy

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, continued to surge in June, according to data released Friday by the Bureau of Economic Analysis (BEA).

The PCE index was up 6.8% for the year ending in June, an increase from the 6.3% that it was at in both April and May, the BEA announced. PCE is the Fed’s preferred measure of inflation because it is “just better at capturing the inflation people actually face in their lives,” and the central bank endeavors to keep it at 2%, Federal Reserve chair Jerome Powell said Wednesday.

Read MoreBiden Administration Accused of Gaslighting Nation with ‘Soviet Level Propaganda’ After Attempting to Redefine Recession

by Debra Heine The White House is being accused of gaslighting the American people with “Soviet levels of propaganda” as Biden officials attempt to change the definition of recession amid economic data that shows the United States is entering into a recession. A recession is traditionally defined as two…

Read MoreCommentary: Historical Recession Signals Are Flashing Red

Unemployment insurance continuing claims increased by 122,000 on a non-seasonally adjusted basis from July 2 to July 9 to 1.45 million, the latest U.S. Department of Labor data shows, as multiple historical recession signals are flashing red.

The number comes as initial unemployment claims have continued ticking upward on both on a seasonally adjusted basis. Since mid-March, when weekly claims hit a low of 166,000, now they are up over 251,000.

Read MoreEconomist: 30 Percent Chance That U.S. Enters a Recession Within a Year’s Time

A Goldman Sachs economist says there is a 30% probability of the U.S. entering a recession within one year and 48% within two years.

Goldman Sachs Chief U.S. economist David Mericle outlined the probability of a recession at an event Tuesday and said that the likelihood of a recession would decrease if the U.S. had not entered one within two years.

Read MoreFederal Reserve Chair Powell Says During Senate Hearing That a Recession Is Possible

Federal Reserve Chair Jerome Powell said the U.S. could enter into a recession when questioned Wednesday during a Senate Banking Committee hearing.

Confronted about 40-year-high inflation and the Fed raising interest rates in response, Powell said he couldn’t know for sure but said a recession, defined as a significant decline in economic activity over time, is possible.

Read MoreRecession Worries Rising Among Economists

Recession worries are rising among economists as inflation continues at high levels.

A top Moody’s economist has predicted a recession could hit within the next two years, but others are saying it could happen sooner.

Read MoreCommentary: A Biden Recession Is Virtually Guaranteed After 10-Year, 2-Year Treasuries Spread Inverts as Economy Overheats from Rampant Inflation

The spread between 10-year treasuries and 2-year treasuries, a leading recession indicator whose inversions have predicted almost all of the U.S. economic recessions in modern history, on March 31 inverted for the first time since Sept. 2019.

When the 10-year, 2-year spread inverts, a recession tends to result on average 14 months afterward, sometimes sooner, sometimes later. The one time there was a head fake on the 10-year, 2-year was in the mid-1990s at a time when inflation was much lower Visit Site than it is now.

As an aside, potentially the Sept. 2019 inversion might have ended up being a premature indicator, too, but then Covid and global economic lockdowns in early 2020 went ahead and ensured a recession even if one was not due. On the other hand, at that point it had been 11 years since the prior recession and so the business cycle was going to end sooner or later.

Read MoreCommentary: Seven Major Failures of the Biden Presidency

With President Joe Biden set to deliver his first State of the Union address on Tuesday night, it’s a good time to ask: How has Biden done as president and what is the actual state of our union?

According to the American people, things aren’t going great.

A CNN poll in early February asked Americans what they thought of Biden’s presidency and what he’s done right since entering office Jan. 20, 2021.

Read MoreCommentary: Inflation Has Arrived

Wildly excessive federal spending is causing major inflation and shortages, which may lead to a recession and perhaps a financial crisis. Despite the evidence of inflation, Congress is proposing to spend $3.5 trillion on top of the $1.9 trillion COVID relief bill passed earlier this year and the intended $1.2 trillion infrastructure bill. For comparison, federal revenue is only expected to be $3.8 trillion this year.

Evidently, the Democratic Party and President Joe Biden have adopted Modern Monetary Theory (MMT) to the peril of every American citizen. MMT, which is similar to Keynesian economics, says that the U.S. should not be constrained by revenues in federal government spending since the government is the monopoly issuer of the U.S. dollar. MMT is a destructive myth that provides cover for excessive government spending. And it’s not modern, since reckless government spending has been around for thousands of years.

Embracing MMT is similar to providing whiskey and car keys to teenage boys. We know the outcomes will not be good.

Read MoreInflation Spikes Again, Marks Quickest Increase in 13 Years

Inflation surged 5.4% over the 12-month period ending in June, the quickest spike since August 2008, a Department of Labor report showed.

The consumer price index (CPI) increased 0.9% between May and June, according to the Labor Department report released Tuesday morning. Economists projected the report would show that CPI ticked up 4.7% between July 2020 and June, The Wall Street Journal reported.

“We’re in a transitional phase right now,” Joel Naroff, the chief economist at Naroff Economics, told the WSJ. “We are transitioning to a higher period of inflation and interest rates than we’ve had over the last 20 years.”

Read MoreArmstrong Williams Commentary: It’s Time to Talk About Recession

Is America in a recession? It’s an unpopular question to ask, but it has now been over 3 months since COVID-19 restrictions were initiated and it is time for us to get realistic about where we are economically so that we can take the proper steps to minimize further damage to our economy. At this point, the unfortunate reality is that regardless of what we do, it is likely that it will take at least several years to see a partial recovery of economic loss and the time that it will take for a complete recovery remains unknown at this point.

Read MoreCommentary: With a 50-Year Low Unemployment Rate, the Recession Clocks Need to be Reset Until After 2020

The U.S. economy got another dose of amazing news on Oct. 4 when the national unemployment rate dropped to a 50-year low of 3.5 percent.

Read MoreCommentary: People Rooting for an Economic Downturn to Oust President Trump, This Has to be the Worst Recession Ever

Below are a few good news economic stories you might have missed since the media created recession fears have been negated by the robust U.S. economy.

Read MoreCommentary: Russia, Racist and Recession Are the New Fake News R Words

Magically and mystically, this minute the favorite “R” word of the Democrats has shifted from Russia to racist to recession in the blink of an eye — all falsehoods — as they desperately hope that the normal economic cycle turns prior to the Nov. 2020 presidential election.

Read MoreCommentary: Is the Federal Reserve Trying to Cause a Recession before 2020?

by Robert Romano Did anyone notice the Fed inverted the yield curve? On May 23, the 10-year Treasury dipped below the federal funds rate, the benchmark interest rate set by the Federal Reserve that it currently has set for a range of 2.25 percent to 2.5 percent, and has…

Read More