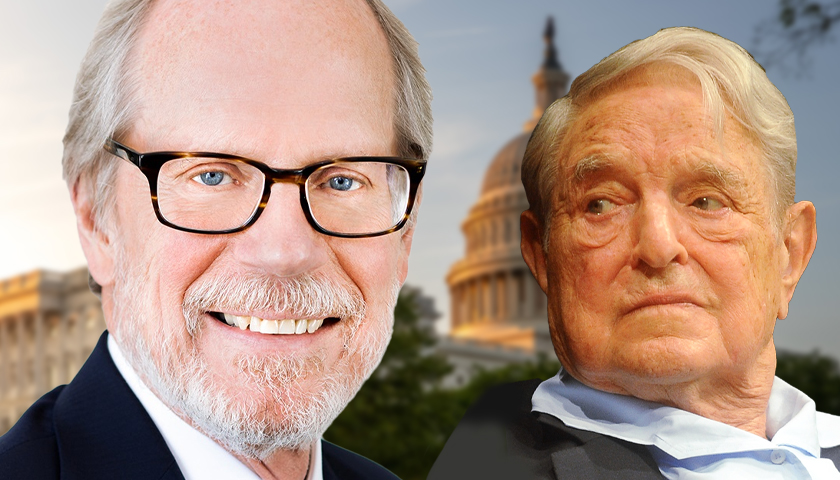

A liberal foundation controlling roughly $1 billion in assets faces accusations of “egregious mismanagement” of funds from the largest Black Lives Matter group in the country.

Black Lives Matter Global Network Foundation (BLM GNF) filed a lawsuit on Monday accusing the Tides Foundation of mishandling funds donated to a “Black Lives Matter Support Fund” administered by Tides, arguing the funds belong to them. Tides, however, contests this by claiming that donations to the fund were actually intended for smaller BLM organizations.

Read More