‘Tren de Aragua’, get to know this name, this gang’s name.

Read MoreTag: small business

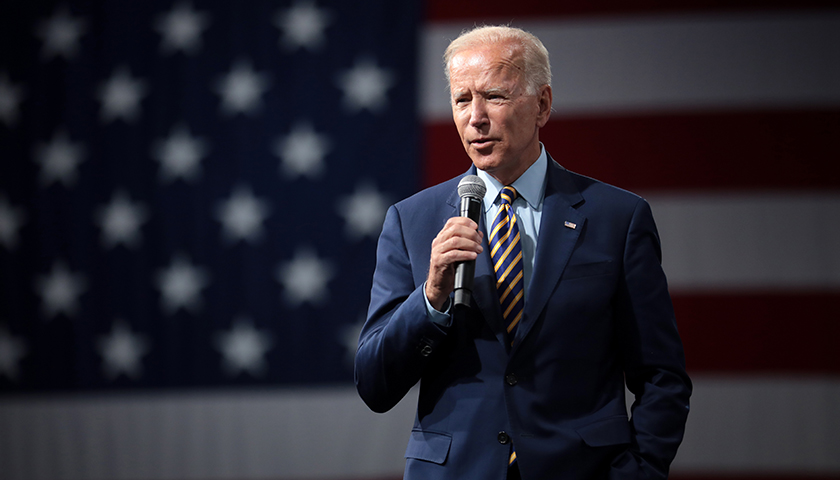

Vast Majority of Small Business Owners Worried Biden’s Economy Will Force Them to Close

A large portion of small business owners are concerned about their future amid wider financial stress under President Joe Biden, according to a new poll from the Job Creators Network Foundation (JCNF) obtained exclusively by the Daily Caller News Foundation.

Around 67 percent of small business owners were worried that current economic conditions could force them to close their doors, ten percentage points higher than just two years ago, according to the JCNF’s monthly small business poll. Respondents’ perceptions of economic conditions for their own businesses fell slightly in the month, from 70.2 to 68.1 points, with 100 points being the best possible business conditions, while perceptions of national conditions increased from 50.4 to 53.2 points.

Read MoreBusinesses Blast New Biden Rule Allowing Union Reps to Inspect Job Sites

Business groups are pushing back against a new Biden administration rule that would allow third-parties, including union representatives, to accompany federal inspectors of job sites.

The Occupational Safety and Health Administration issued the final rule earlier this year, but critics say the rule goes beyond safety needs and panders to unions and their recruitment efforts. The rule would apply even to job sites where workers have not unionized.

Read MoreSmall Business Owners Lament Inflation

As inflation continues to rise this year, small businesses are feeling the pain.

The National Federation of Independent Businesses released a survey of small business owners Tuesday that found the nation’s job creators cite inflation as their top concern more than any other issue.

Read MoreCommentary: The Federal Government is Deciding Who Can Start a Small Business

Just when it seemed impossible for things to get tougher for small businesses, the federal government decided to make things worse.

Small businesses have had a tough run for the last few years. Record inflation, high interest rates, and workforce shortages have led to widespread pessimism among small businesses. The last thing they need is more government interference, but that is exactly what is happening.

Read MoreSoaring Interest Rates Are Squeezing Out Small Businesses

Small businesses are feeling the effects of the Federal Reserve’s interest rate hikes as tightening credit puts more businesses and workers in dangerous positions, according to The New York Times.

Interest payments for small businesses will rise to about 7 percent of revenues next year on average, as opposed to being just 5.8 percent of revenues in 2021, according to the NYT. The Fed has raised its federal funds rate to a range of 5.25 percent and 5.50 percent following a series of 11 hikes that started in March 2022, bringing the rate to its highest point in 22 years.

Read More69 Percent of Minnesota Small Business Owners Want Republicans to Sweep Congress

Nearly 70% of Minnesota small business owners said in a survey that it’s best for business if Republicans control Congress.

Between Oct. 1 and Nov. 2, Alignable asked 4,795 randomly selected U.S.-based business owners “What outcome to the November midterm elections would benefit your business the most?”

Alignable Head of Research, Corporate Communications and News Chuck Casto told The Center Square Thursday that the national survey included 367 Minnesota businesses.

Read MorePoll: Small Business Optimism Remains Near Record Lows

Small business optimism remains near record lows, as small business owners believe that inflation, supply chain problems and tax increases pose serious threats to small businesses, according to a Friday poll by the Job Creator’s Network Foundation (JCNF).

Read MoreSmall Businesses Risk Shutting Down in Droves Amid Elevated Inflation, Energy Prices

Nearly half of American small business owners say they are at risk of closing down this fall, according to new survey data.

The small business network Alignable released the survey, which found that “47% of small business owners … say their businesses are at risk of closing by fall 2022, unless economic conditions improve significantly.”

Read MoreCommentary: Protect Small Businesses from the Scourge of Stolen and Counterfeit Goods

Recent images from the Los Angeles railyards of a sea of cardboard wreckage, the remnants of thousands of stolen packages, have made national headlines. Union Pacific railroad said criminal rail theft in LA has increased by more than 2.5 times since December 2020. Yet while most media coverage focuses on this third-world scene, little has been made of the consequences for the small business sellers ripped off by this grand theft.

Whether it comes in the form of widescale package theft by criminal enterprises or organized smash-and-grab robberies at brick and mortar stores, theft has become a big problem for small businesses. A new survey finds that nearly all small business owners experienced an increase in theft in 2021.

This isn’t the shoplifting of your parent’s generation. Elaborate criminal networks steal and resell goods at below-market rates on internet marketplaces such as Amazon, Facebook, eBay, and Alibaba. The cost of lost inventory and ensuing cut-rate online competition puts tremendous pressure on small business margins that are already strained by the highest inflation in 40 years and severe supply chain disruptions.

Read MoreBusiness Owner Jailed for Violating Walz Orders Released from Custody

An Albert Lea woman who was sentenced to 90 days in jail for violating Gov. Tim Walz’s COVID-19 executive orders was released from custody Saturday morning.

Lisa Hanson, owner of The Interchange Wine and Coffee Bistro, refused to close her business when Gov. Walz ordered all bars and restaurants in the state to shut down. She was found guilty of six misdemeanors as a result.

Prosecutors argued for a $500 fine and several days in jail, but Judge Joseph Bueltel wanted to make an example out of Hanson, which he made clear in court. Bueltel reprimanded Hanson for “making money” while “suckers down the street closed.”

Read MoreReport: Private Companies Added Half as Many Jobs as Expected in July

Private companies added 330,000 jobs in July, far fewer than expected and the lowest amount since February, according to a major payroll report.

The 330,000 jobs added to private payroll last month represented a significant decline from the 680,000 jobs added in June, the ADP National Employment Report showed. Economists predicted that private companies would add 653,000 jobs in July, nearly double the number reported Wednesday, according to CNBC.

Read MoreSurging BBQ Companies Go Public, Signaling Continued Post-Pandemic Shift to Home Cooking

Multiple home barbecue companies are going public after a successful year and a half amid the COVID-19 crisis, an apparent reflection of increasing consumer orientation toward home cooking after many months during which dining out was sharply curtailed.

Traeger — a manufacturer of automated wood-pellet smokers — this week announced an initial public offering of 23,529,411 shares of common stock at as much as $18 per share. The company was expecting to realize around $400 million in the IPO.

The company in its IPO prospectus said it “more than doubled revenue from $262.1 million in 2017 to $545.8 million in 2020,” with huge surges in social media followings last year

Read MoreCommentary: A January 6 Detainee Speaks Out

Joe Biden’s Justice Department notched another victory last week in the agency’s sprawling investigation into the January 6 protest on Capitol Hill against Biden’s presidency.

On Wednesday, Michael Curzio pleaded guilty to one count of parading, demonstrating, or picketing in the Capitol building. The government offered the plea deal to Curzio’s court-appointed attorney in June; Curzio faced four misdemeanor charges, including trespassing and disorderly conduct, for his role in the Capitol breach.

Curzio will pay the government “restitution” in the amount of $500 to help pay for the nearly $1.5 million in damages the building reportedly sustained. (The Architect of the Capitol initially said the protest caused $30 million in damages but prosecutors have set the figure far lower.)

Read MoreSmall Business Owners Struggling to Find Workers

Small business owners are continuing to have problems attracting new workers in the wake of the coronavirus pandemic and are trying to entice them with new incentives, a new report from the U.S. Chamber of Commerce shows.

“Small businesses are bearing the brunt of the current worker shortage,” said Tom Sullivan, vice president of small business policy at the Chamber. “Many have given up on actively recruiting new workers as it is too hard to find skilled and experienced workers for their open positions.”

Read MoreBusiness Groups Slam Biden’s ‘Flawed’ Competition, Antitrust Executive Order

President Joe Biden’s competition and antitrust executive order will harm American consumers, groups representing both large and small businesses said.

The leading groups — including the Chamber of Commerce, Job Creators Network (JCN) and the National Association of Manufacturers (NAM) — slammed Biden’s executive order, arguing that it will harm competition and present a host of challenges to small businesses. The business groups said the order is an example of big government attempting to exert control over the free market via onerous rules and regulations.

“This executive order amounts to a bizarre declaration against American businesses, from the largest to the smallest,” Small Business and Entrepreneurship (SBE) Council Chief Economist Raymond Keating said in a statement. “It’s hard to understand why a White House would go down such a path, especially as the economy is digging out from the COVID-19 disaster.”

Read MoreCommentary: As President Biden’s Deputy Secretary of Labor, Julie Su Would Take California’s Small-Business Nightmare National

Last Thursday, Senate Majority Leader Chuck Schumer filed cloture on the nomination of Julie Su, California’s top labor official, to become President Joe Biden’s deputy secretary of labor.

Su’s confirmation vote will likely occur soon after the Independence Day Senate recess. That’s bad news.

After all, Su leads California’s Labor and Workforce Development Agency, presiding over one of the most anti-small business regimes in the country. If confirmed as second-in-command at the Department of Labor, she would use her position to expand California’s war on small businesses nationwide. On behalf of their small business constituents, Senators must oppose Su’s confirmation.

Read MoreCommentary: It is Time to Fight for the Rights of Independent Businesses

As a very young man, I was fortunate enough to start my own company out of my apartment using a small amount of investment capital from friends and family. Over time, that business grew to have over 6,000 employees and revenues in excess of $2 billion. Over nearly a 40-year span, my team and I built what some would consider a remarkable track record, as measured by both sales and profits.

Because of my experience growing that business, I feel a special kinship with small, privately owned businesses and their owners. I also come from a middle-class background, one that shaped me into the person I am today. It is through both the lens of entrepreneur and member of the middle-class that I look through when reflecting upon this Independence Day.

Read MoreJust Six Percent of Small Businesses Have Fully Recovered Pandemic Losses, Poll Shows

Just 6% of small businesses that were negatively impacted by the coronavirus pandemic have fully recovered their losses, a Job Creators Network survey showed.

The vast majority of U.S. small business owners continue to “claw their way out” of the hole caused by the coronavirus pandemic, according to the poll commissioned by small business advocacy group Job Creators Network (JCN) and shared with the Daily Caller News Foundation. While 6% of small business owners that suffered losses related to the pandemic said they have recovered, 43% believed they would be fully recovered within six months.

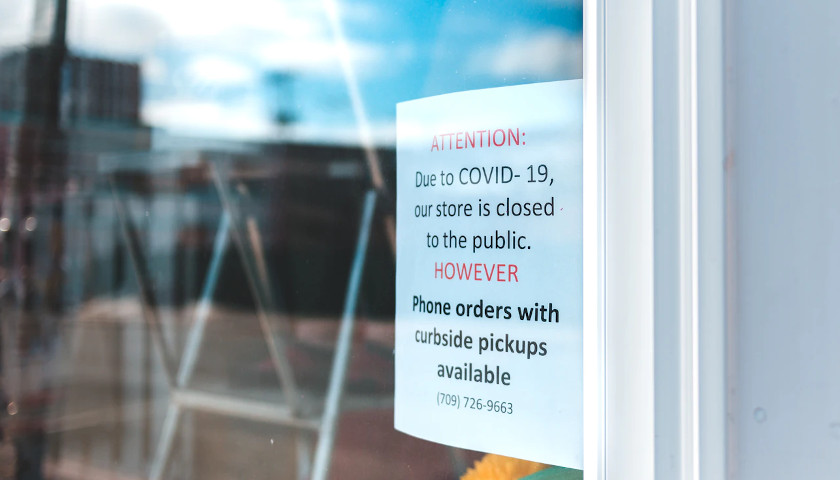

Read More‘My Income Has Dropped to Zero’: About 45 Percent of Small Businesses Risk Closure Within Months

At least 13.9 million of the nation’s small businesses are at serious risk of shuttering their doors by April 1, a recent industry report found.

Forty-four percent of the country’s 31.7 million small businesses are at risk of closing by the end of the first quarter, according to small business group Alignable. Small businesses on the brink of closure expect to earn less revenue than their owners estimate is needed to stay afloat.

Read MoreMore Than $1 Trillion in Coronavirus Aid Hasn’t Been Spent, Includes $120 Billion for Small Businesses

About $1.1 trillion in coronavirus aid, including more than $120 billion for small businesses, has still not been spent, according to a memo Republicans are circulating on Capitol Hill.

The more than $1 trillion in unspent coronavirus relief funds represents a significant portion of the $4 trillion allocated by Congress as part of multiple 2020 stimulus packages, according to the Republican Study Committee (RSC) memo reviewed by the Daily Caller News Foundation. Of the $828 billion allocated for small business loans, about $123.7 billion has not been spent, according to Small Business Administration data.

Read MoreDave Portnoy’s ‘Barstool Fund’ Raises $20M, Helps More Than 90 Small Businesses

The Barstool Fund, created by Dave Portnoy, has helped raise more than $20 million, helping nearly 100 small businesses hurt during the coronavirus pandemic lockdowns. Portnoy started the Barstool Fund one month ago with his own $500,000 to help small businesses.

The fundraiser has raised $20,119,270 from more than 156,000 donors and has aided 92 small businesses across the country as of Thursday evening.

Earlier in the day, Portnoy announced his fundraising success on Twitter, but stressed that their mission is far from over.

Read MoreFour California Small Business Owners Share Their Struggles to Survive Under Lockdowns

California small businesses are crumbling under the weight of a new stay-at-home order and a lack of meaningful financial assistance.

Democratic Gov. Gavin Newsom issued a new region-based lockdown order for California on Dec. 3, forcing more California businesses to close their doors or severely limit operations.

Read MoreMinimum Wage Hikes Set for 2021 Imperil Businesses Struggling Amid COVID Shutdowns

More than 80 states and local municipalities are slated to see minimum wage hikes in 2021, even as business owners continue to struggle during the coronavirus pandemic.

The Employment Policies Institute, a non-profit based in Washington, D.C., that studies how public policy impacts employment growth, released a comprehensive list of the minimum wage increases that will go into effect next year and in subsequent years.

“Minimum wage increases are demonstrated to cause job losses even in times of economic health,” said Michael Saltsman, EPI’s managing director. “These states and local areas are increasing the cost of labor as businesses are dealing with forced closures or a drastic drop in revenue. Employers and employees will pay the price for these misguided good intentions.”

Read MoreFour California Small Business Owners Share Their Struggles to Survive Under Lockdowns

California small businesses are crumbling under the weight of a new stay-at-home order and a lack of meaningful financial assistance.

Democratic Gov. Gavin Newsom issued a new region-based lockdown order for California on Dec. 3, forcing more California businesses to close their doors or severely limit operations.

Read MoreChamber: Most Small Businesses Say More Federal Aid Necessary for Success

Some two-thirds of small business owners say more federal relief funds are needed for them to be successful in the coming year during the ongoing coronavirus pandemic, according to the fourth quarter Small Business Index survey from the United States Chamber of Commerce.

Read MoreDefiant: Minnesota Businesses Plan Mass Reopening

by Anthony Gockowski More than 150 businesses plan to reopen this week in defiance of Minnesota Gov. Tim Walz’s coronavirus shutdown. The businesses have organized as the Reopen Minnesota Coalition. This group has created a Facebook page and GoFundMe to raise awareness and money for business owners who will likely face legal consequences…

Read MoreRubio Calls for More Small Business Loan Money in Compromise COVID-19 Relief Bill

The $908 billion pandemic stimulus compromise package being discussed in the U.S. Senate is a hopeful sign of progress, Florida Republican U.S. Sen. Marco Rubio said, but it won’t garner his support until more assistance is tabbed for small businesses.

The four-month emergency package introduced Tuesday by a bipartisan coalition of senators and House representatives on Capitol Hill would fund transportation, food assistance, coronavirus testing centers and the Paycheck Protection Program (PPP) crafted by Rubio’s Small Business and Entrepreneurship Senate Committee to help businesses pay their employees during shutdowns rather than lay them off.

Read More80 Percent of Small Business Owners Are Waiting to Receive a Loan from the SBA, Survey Finds

The National Federation of Independent Business (NFIB) Research Center released a survey Tuesday that said 80 percent of small business owners are still waiting to receive a loan from the Paycheck Protection Program (PPP).

“Small businesses were prepared and ready to apply for these programs, the only financial support options for most, and it is very frustrating that the majority of these true small businesses haven’t received their loan yet,” Holly Wade, NFIB Director of Research & Policy Analysis, said. “Small businesses make up nearly half of the economy and it’s crucial that their doors stay open.”

Read MoreWells Fargo Bows Out of Small Business Bailout Program After Receiving $10 Billion of Loan Applications

One of the largest banks in the United States announced that it is no longer accepting applications for a federal program aimed at rescuing small businesses affected by the coronavirus pandemic.

Wells Fargo has stopped accepting new applications for the government’s Paycheck Protection Program, an initiative created by the government to assist U.S. businesses that employ fewer than 500 people. The bank’s decision came after it was inundated with billions of dollars in loan requests since Friday.

Read MoreU.S. Chamber: More than Half of U.S. Small Businesses to be Closed within Two Weeks

Nearly one in four small businesses – 24 percent – have temporarily shut their doors due to the response to COVID-19 in the U.S., and an additional 40 percent said they likely will do so within the next two weeks, according to a new survey from the U.S. Chamber of Commerce and Metlife.

Read MoreCommentary: Small Businesses Urge Federal and State Governments to Reopen America ASAP

Due in large part to government edicts, religious, social, and political gatherings, have been cancelled or drastically altered to meet government requirements. Schools and colleges have closed so there will be no proms or graduations to attend this spring. Restaurant dining rooms are closed, as are community centers, fitness centers, salons, barbershops, theaters, retail stores, and malls. Theme parks, beaches, and even some public parks are closed. Air travel and the use of public transportation has declined precipitously. Traffic on the roads is eerily light, and parking lots are nearly empty.

Of the businesses that have remained open, many have reduced their operating hours. While one can reasonably expect that stay-at-home orders will reduce Chinese coronavirus cases, it remains to be seen what the human and economic toll of these orders will be; but we do know that they are devastating to small businesses and their employees.

Read MoreCommentary: Trump Virus Response Calls for Covering Payroll for Every Small Business in America with $300 Billion

In order to meet payroll for every small business and nonprofit in America up to 500 employees for the next month or so during the Chinese coronavirus outbreak, President Donald Trump and Senate Majority Leader Mitch McConnell (R-Ky.) are proposing $300 billion of forgivable emergency loans.

Read MoreSmall Business Saturday Turns 10 Years Old

Small Business Saturday (SBS), the day to support your local businesses and economy, turns 10 years old today.

Read MoreThis New Health Plan Expansion Is a Godsend for Small Businesses Like Mine

by Kalena Bruce Last month, the Trump administration took a concrete step to lower skyrocketing health care costs for middle-class families like mine. The Department of Labor issued a final rule expanding association health plans, which allow small businesses like my farm to band together with others to negotiate bulk rates…

Read MoreA Record Number Of Small Businesses Are Raising Wages Amid Tight Labor Market

by Will Racke A greater share of small companies in the U.S. are raising wages than at any time in the past three decades, according to a survey released Thursday from the nation’s biggest independent business association. A seasonally adjusted 35 percent of small business owners reported they have increased…

Read More