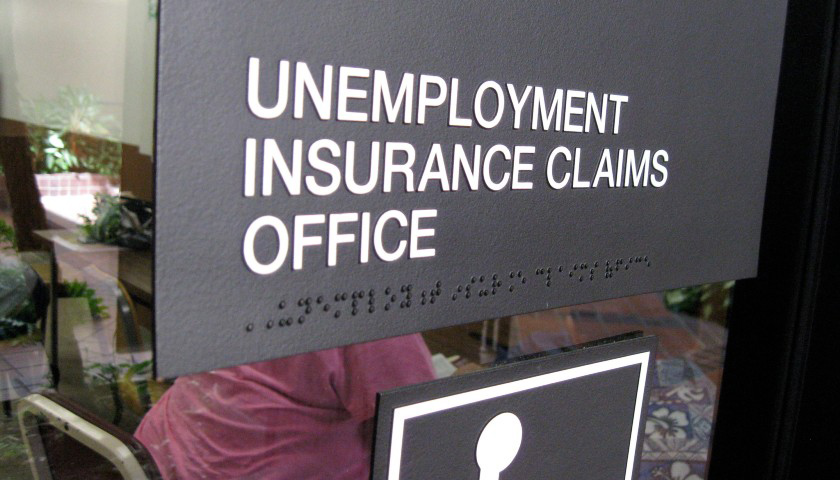

The U.S. economy reported an increase of 943,000 jobs in July and the unemployment rate fell to 5.4%, according to Department of Labor data released Friday.

Total non-farm payroll employment increased by 850,000 in July, according to the Bureau of Labor Statistics report, and the number of unemployed persons decreased to 8.7 million. Economists projected 845,000 Americans would be added to payrolls prior to Friday’s report, The Wall Street Journal reported.

“The jobs recovery is continuing, but it’s different in character to any we’ve seen before,” payroll software firm ADP economist Nela Richardson told the WSJ. “I had been looking at September as a point when we could gain momentum—with schools back in session and vaccines widely available. But with the delta variant, we need to rethink that.”

Read More